NatWest is one of the UK’s “Big Four” banks, alongside HSBC, Barclays, and Lloyds. It also offers some tempting perks for business customers, such as free accounting software and the chance to bank for free for the first two years. But is a NatWest business account really the right choice for you and your company? We’ll assess fees, requirements, the account opening process, and more to help you decide.

- In this article

- Types of Business Accounts Available

- Requirements to Open a NatWest Business Bank Account

- How to Open a NatWest Business Account

- NatWest Business Bank Review: Key Features

- How Long Does it Take to Open a NatWest Bank Account

- Can I Open a NatWest Bank Account Online?

- NatWest Business Bank Fees

- NatWest vs ANNA Business Account Fees Compared

- A New Era of Banking is Here

Types of Business Accounts Available

NatWest offers four types of business accounts:

- Start-Up account. For growing new businesses. The account includes extra support and free programs for businesses.

- Business bank account. The standard business account offering, suitable for more established businesses or new businesses with a high turnover.

- Community bank account. For nonprofits or charities.

- Mettle account. A mobile business account designed for sole traders or limited companies with a maximum of two owners with an account balance of under £1 million.

In comparison, ANNA offers three types of business accounts:

- Pay As You Go: Allows account holders to only pay for what they use.

- Business: The standard account, providing the basics for still-growing businesses at a lower cost.

- Big Business: Suitable for businesses prioritising the ability to scale, typically for those with higher turnover.

Requirements to Open a NatWest Business Bank Account

The generic requirements for all NatWest business accounts are as follows:

- 18 years old or above

- Have the right to be self-employed in the UK

- Not declared bankrupt

- No County Court Judgment (CCJ)

You’ll also need to show some identity documentation, such as a driver's licence, passport, or EU identity card.

Community account holders must be a registered not-for-profit. This could be a non-personal trust, a charitable incorporated organisation (ICO), or charity registered through Companies House, a club, a society, or a place of worship.

Turnover and Trading Requirements

NatWest also imposes some additional requirements on certain account types.

Start up account holders must have a turnover of less than £1 million and a trading history of a year or less.

Meanwhile, standard business account holders must fit into one of the following categories:

- Trading for less than a year with a turnover of over £1 million

- Trading for more than a year with a turnover below £1 million

How to Open a NatWest Business Account

It’s relatively simple to apply for a NatWest Business Account.

Just follow this process:

- Choose an account.

- Make an application. This can be done online or at a physical branch

- Fill in business and personal details. This includes providing contact details, business address, an estimate of turnover, and your trading activity.

- Verify your identity. A third party called Mitek carries out this process, which involves checking a photo ID (such as a driving licence or passport), a short video or selfie, and possibly proof of address.

- Wait to receive your welcome email confirming your application was successful.

In some cases, you may also need to sign a tax declaration or a mandate through Adobe e-sign.

As with any bank account application, a credit check is also part of the process.

If NatWest requires any further information, they will contact you by phone or email.

NatWest Business Bank Review: Key Features

All NatWest accounts offer free access to FreeAgent accounting software, which businesses can use to help them prepare for tax season and organise their transactions.

For a standard business bank account, one of the standout features is that NatWest will give you a Relationship Manager, depending on turnover and other eligibility criteria. This manager provides guidance and support to help businesses grow and navigate challenges.

Another major perk is access to 24/7 support through a call centre, plus a digital assistant to answer simple inquiries. However, it should be noted that the bank also has a 1.4-star rating on Trustpilot, which indicates low customer satisfaction.

All accounts are part of the Financial Services Compensation Scheme (FSCS), meaning deposits of £85,000 are protected.

NatWest also offers the following features:

- Option to make cash deposits

- Option to make cheque deposits

- International payments

- Multiple user access

- Invoice creation and sending

- Option to apply to Bankline to view various accounts made under the same profile

- A mobile app

NatWest vs Challenger Bank Features

New digital challenger banks often provide features that traditional institutions like NatWest can’t.

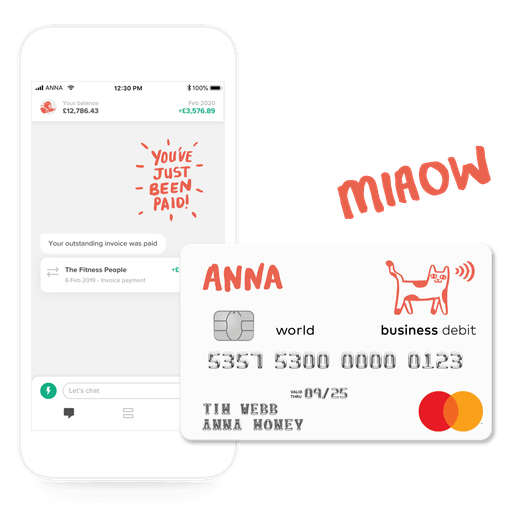

For instance, with ANNA business account you don’t need an additional complicated, pricy accounting software. ANNA comes with automated accounting and tax filing. It will remind you to take a picture of receipt everytime you make a business purchase, will pull the data from all your business accounts through open banking, as well as create and chase invoices for you. You have your banking and accounting in one place, saving you time and money.

In addition, ANNA offers up to 35% cashback on hotels, allowing businesses to save money when they pay for business expenses like travel. Users can also make pots to save money, which is a useful way to organise finances for different purposes, like suppliers or VAT.

It also offers helpful services such as:

- Confirmation statement filing

- Professional invoices

- A payment collection link

- Payroll management

- Expenses management

ANNA also provides 24-hour support. It typically takes less than a minute to talk to a human when using the live chat feature. Plus, ANNA has a much higher Trustpilot rating of 4.6, showing that customers are generally happy with the service they receive.

How Long Does it Take to Open a NatWest Bank Account

Opening a NatWest bank account takes just a day, meaning you may be able to apply for and open your account on the same day.

Within a few days, you will receive a debit card in the post, which you must activate to make payments. It will also take a few days to activate online banking.

However, the process may take slightly longer if any of the following apply:

- You take cash payments

- There are more owners

- You undertake overseas transactions

If you apply for a business credit card at the same time as opening your account, Natwest will process this application after opening your account. It typically takes 10-12 working days after opening a current account for NatWest to carry out its security check and send your card and PIN in the post.

Thanks to the simplified online process, you can sign up for ANNA in less than ten minutes. Entrepreneurs simply need to download the app directly to their phone, enter their mobile number and email, and answer a few questions.

Can I Open a NatWest Bank Account Online?

Yes, the easiest way to open a Nawest bank account is online, and the bank encourages you to take this route if you want to get started as quickly as possible.

However, it’s also possible to open an account in a branch.

NatWest Business Bank Fees

NatWest offers free banking on everyday transactions for the first two years, after which account holders will face fees.

This may seem like a generous offer, but there are a couple of things to keep in mind:

- These free “everyday transactions” don’t include everything, such as international payments.

- The initial two years will be over before you know it, after which it can be tricky to change your bank account as doing so may inconvenience your business or customers.

Plus, Mettle customers benefit from no monthly charges or transaction fees, provided they meet the criteria.

NatWest’s Community Bank Account offers free banking if the account holder is an existing NatWest personal or business banking customer and has a community account with a turnover below £100,000.

Transaction Fees

After the two-year introductory period, NatWest offers a standard tariff across all its accounts.

These fees can be found online, but below we’ve summarised the charges below, which are correct as at 30 August 2025.

Customers must pay £0.35 per transaction (including online, mobile, and telephone banking payments, cashpoint withdrawals, direct debits, and standing orders).

There’s also a fee of £0.95 per £100 for paying cash in or out (at bank branches, post offices, or through Business Quick Deposit). Plus, there’s a fee of £0.95 per item for manual cash or cheque handling. Cheques paid in via the NatWest Mobile App are charged at £0.75 per item.

Meanwhile, ANNA charges 20p per bank transfer for its Pay as You Go account, free bank transfers for its Big Business accounts, and 20p per transfer with 50 free transfers for its standard Business Account.

Instead of transaction fees, businesses pay a fixed amount to maintain their account (with the exception of the Pay as You Go account), of £14.90 for Business and £49.90 a month for Big Business.

Card Fees

NatWest has an annual fee of £30 for its business credit card.

ANNA charges no annual fees on its cards, and each account type includes at least one card in its package.

Big Business customers get unlimited free cards, while Business account holders get up to 5 cards for free and pay £3 per month for each additional card. Pay as you go customers get one free card.

International Payment Fees

NatWest’s international payments are summarised in the table below:

The bank also has a 2.75% non-sterling transaction fee for cash withdrawals outside the UK, foreign currency withdrawals in the UK, or purchases made with a foreign currency.

ANNA has a lower £5 payment for international payments, although standard business accounts get one free SWIFT payment and Big Business accounts get four free SWIFT payments.

Plus, its 1% currency conversion fee is far below NatWest’s 2.75% non-sterling transaction fee. Big Business accounts have an even lower currency conversion free of just 0.5%.

NatWest vs ANNA Business Account Fees Compared

Let’s take the example of a fictional entrepreneur — a Liverpudlian called Amelia who runs an ecommerce store selling T-shirts.

Her monthly business transactions look something like this:

- Domestic Payments: 200

- International Payments; 5 (with a total value of £200)

- Cash Deposits: £500

- Card Payments: £3,000

If Amelia used a business account with NatWest, she would face the following payments after the first two years of free transactions:

- Domestic Payments: 200 * 0.35 = £70

- International Payments: 5 * £15 = £75

- Cash Deposits: £500 * (£0.95 /100) = £4.75

- Card Payments: £3,000 * 2.75% = £82.50

- Monthly Account Fee: £0

Meanwhile, if she opted for ANNA instead, her payments would be as follows for a standard Business account:

- Domestic Payments: 50 free transactions plus 150 transactions at a rate of 150 * £0.2 = £30

- International Payments: 5 * £5 = £25

- Cash Deposits: No fees

- Card Payments: No foreign transaction fees

- Monthly Account Fee: £14.90

Adding everything together, Amelia could save over £150 a month by switching to ANNA.

A New Era of Banking is Here

Just a few decades ago, entrepreneurs looking for a business account were limited to Big Four banks like NatWest or other financial institutions. If they didn’t want to stomach the high fees or poor customer service, they had little option but to grit their teeth and hope for the best.

The last few years have seen an explosion of fintech in the UK, which has opened up new options and given businesses genuine alternatives. New digital banks like ANNA are offering the same basic features and services you’d expect from a business account at a cheaper price and with additional modern features, giving the traditional institutions a serious run for their money.

Ready to embrace the new age? Open a business account with ANNA today — you’ll even get the first month for free.

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)