When you’re starting out in business it can be tricky to know if you should register for VAT or not. So we’re taking a look at when you should do it – and how.

When and how should I register for VAT?

If your taxable turnover goes over the VAT threshold (it’s currently £85,000) within a 12 month period you have to be registered for VAT. Simple as that. And if you know your turnover is going to exceed the threshold in the next 30 days, you also need to register.

Hang on… what’s taxable turnover?

VAT taxable turnover is the total value of everything you sell that isn’t exempt from VAT. So keep track of your sales throughout the year to make sure you know if you’re approaching the VAT threshold.

Can I register for VAT if I’m below the threshold?

Yes. You can voluntarily register for VAT if you’re trading below the threshold. You’ll then be able to claim back VAT charged on your expenses – but you’ll also need to charge VAT on your sales.

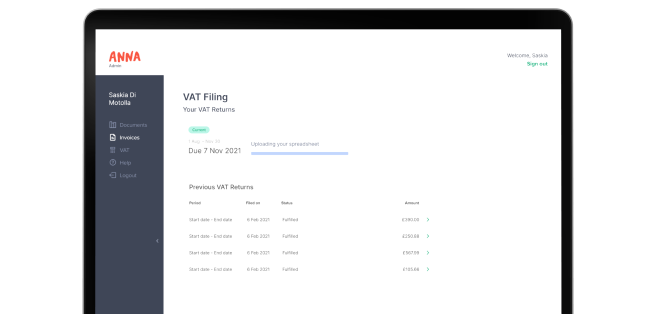

How do I register for VAT?

You can register online via the government website. You’ll need your government gateway details to log in and access the VAT registration form.

When you register you’ll need to provide details like your current and expected turnover, your business activity and business bank details.

You can also register via post by completing one of the following forms:

You should post your completed form to:

- BT VAT

- HM Revenue and Customs

- BX9 1WR

HMRC aims to send you your VAT registration certificate within 30 working days – but it can take longer than this. If you haven’t heard from them by then do chase them up.

If you’ve registered online your certificate will be sent to your online VAT account. If you’ve registered by post it’ll be sent to the address you included on your form.

Your registration date serves as your ‘effective date of registration’. From this date onwards, you’ll need to report your sales and expenses to HMRC and pay any VAT owed from your taxable sales over to them.

And that’s it. Welcome to the world of VAT!

Open a business account in minutes