Bookkeeping. It’s one of those words we’ve all heard of, but not all of us know what it means. Even in the world of small businesses and start-ups, you might not be completely clear about what bookkeeping is and how it affects you. Bookkeeping can affect everything from a small businesses cash flow, tax returns and financial reporting – so it’s worth keeping on top of the basics.

So, what exactly is bookkeeping, and why do you need to do it?

Simply put bookkeeping is keeping a record of your business transactions. These transactions might be sales or purchases, receipts or payments. They might be made by or to another business or person, or bookkeeping software. Phew.

What happens to that record? After a bookkeeper has made the record, it’s passed onto an accountant to prepare financial accounts and then file the financial reports that are required by HMRC and other government agencies for tax returns and VAT.

There are different ways to record financial transactions, from simple methods like single-entry bookkeeping to more sophisticated systems like double-entry bookkeeping. Whatever method they use, a bookkeeper or accountant uses the records to prepare an income and expenditure account to see if the organisation is making a profit and help manage cash flow.

What is a ‘bookkeeper’?

A bookkeeper is the person who maintains the day-to-day financial records of an organisation.

Accountancy firms often employ bookkeepers to maintain their clients’ books and may provide a bookkeeping service as part of what they offer. In this set-up, the bookkeeper may maintain the accounting records, prepare the VAT Return and prepare a set of management accounts each quarter.

Lots of businesses use an accountant to prepare their end-of-year accounts and calculation of Corporation Tax. If the books have been well maintained by an experienced, competent bookkeeper the accountant’s bill will often be a lot lower. If the accountant is confident the books are accurate, there will be less need for checking and testing.

Can I do my own bookkeeping?

Many start-up businesses do their bookkeeping themselves. They use a spreadsheet to track their income and expenditure. This can be quite slow and it’s easy for mistakes to creep in – which is why we recommend ANNA’s own bookkeeping tools.

Why do I need to maintain my books?

Even small businesses and sole traders need to maintain their books to make sure they have a detailed history of their financial transactions.

It’s very important that your business bank accounts are reconciled correctly – so you can be confident that all your transactions are recorded, none are missed, customers are all paying you and you’re also paying your suppliers on time.

A well-maintained set of books lets you see if your business is profitable or not. If your spending exceeds your income the business is making a loss. If a business keeps making a loss you’ll need to consider how long you can support the business and if it has a long-term future.

Alternatively, bookkeeping can show how successful a business is; if the business is successful and making a profit, you may want to invest more capital and expand the business.

Of course, the main reason small business owners need to maintain accurate books is the legal obligation to pay any tax that’s due. If you don’t have accurate records your accounts might not be correct, meaning inaccurate tax returns and the possibility of fines or other penalties from HMRC.

On 1 April 2019 HMRC started to roll out the first phase of their “Making Tax Digital” initiative. Since then all businesses whose VATable income exceeds the registration threshold of £85,000 have to submit their VAT Return digitally via the HMRC portal.

Can ANNA help with my bookkeeping?

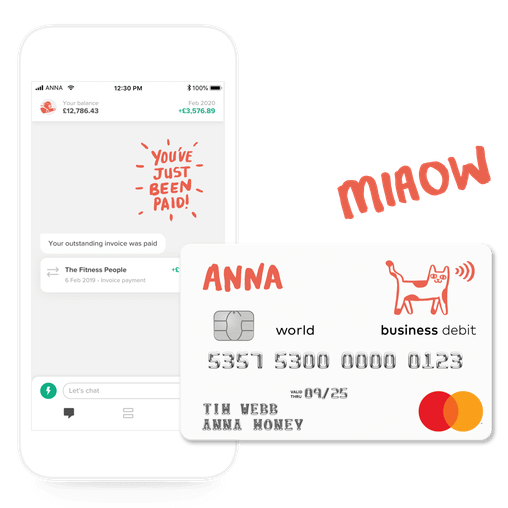

ANNA is more than a business banking account – it helps you do your own accurate bookkeeping on the go.

It automatically calculates your tax, so you can file your own VAT Return with confidence (if you pay VAT), and calculate your taxable profits.

ANNA tracks the money coming into your bank account and matches it to paid invoices – this keeps an accurate record of sales income including (if you’re vat registered) VAT charged to your customers – which you will owe to HMRC through your VAT returns.

ANNA also helps you stay on top of your expenses. With any business purchase just take a photo of your receipt in the app or email it to receipts@anna.money and ANNA will automatically record and categorise the expense, including extracting the VAT paid ( if you’re VAT registered you’ll get this back when you submit your VAT return). Receipts are stored electronically (HMRC only requires you to keep digital records) so say goodbye to boxes of receipt at home!

As tax-filing deadlines approach ANNA estimates the amount of tax you owe HMRC and sends you a reminder of when the tax is due. ANNA is fully now compliant with HMRC’s Making Tax Digital requirements, which means you’re able to submit your financial data directly from your ANNA app to HMRC.

Bookkeeping with ANNA is simple, easy and reliable. It can save you money and help you focus on what you really want to do – building your business.

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)