VAT Registration number in the UK: a comprehensive guide

Businesses in the UK with a turnover of over £90,000 are legally required to register for VAT, and are issued a VAT Registration Number (VRN). Companies can also voluntarily register for a VRN if they want. But what does VAT registration mean for your business? ANNA is here to help explain what becoming registered for VAT means for you.

- In this article

- What is a VAT number?

- VAT Number structure

- Why do I need a VAT registration number (VRN)?

- Where can I find my VAT number?

- Registering for a VAT number

- Verifying a VAT number

- Differences between VAT numbers and other registration numbers

- Obligations associated with VAT numbers

- Conclusion

- How ANNA can help you

- Frequently asked questions

What is a VAT number?

A business's VAT number is used to track and report their VAT obligations to the tax authorities – in the UK, that’s HMRC.

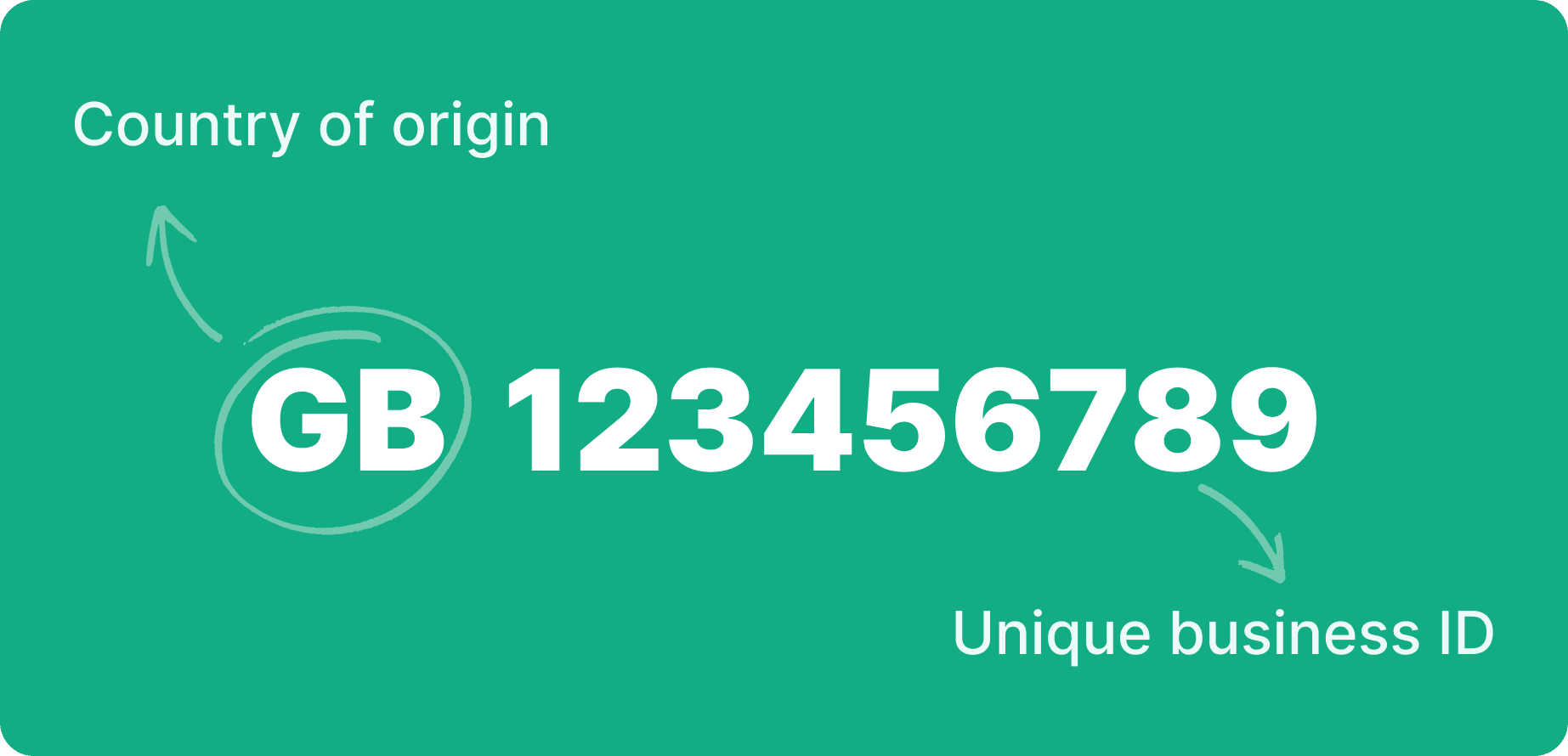

VAT Number structure

UK VAT numbers follow a specific structure, consisting of nine digits, starting with the prefix "GB" for the UK, GB123456789 for example. The first two letters denote the country, while the subsequent numbers are unique to the business.

European countries follow similar patterns, such as "DE" for Germany or "FR" for France. The following numbers can be longer or shorter.

Why do I need a VAT registration number (VRN)?

A VRN is a legal requirement for businesses that meet the VAT threshold. Once you’ve registered, you can (and must) charge VAT on most goods and services. It also allows businesses to reclaim VAT on purchases, while still staying compliant with HMRC regulations.

Get familiar with your VAT number, because showing your VAT number on invoices, receipts, and other business documents is mandatory. It also has to be on display on your website and any other kind of public communication, such as marketing materials.

You’ll use your VAT registration number in a range of situations, including issuing invoices to clients, filing VAT returns with HMRC, and when you claim VAT back on goods or services you’ve bought for your business. It’s also necessary for customers and suppliers to verify your VAT status.

Where can I find my VAT number?

To find your VAT number, you can check your VAT registration certificate, which HMRC provides once you complete the registration process. You can also call the HMRC VAT helpline on 0300 200 3700.

Registering for a VAT number

To get a VAT number, you must register your business for VAT with HMRC. You can do this online through the HMRC VAT registration portal.

How to get a VAT number

- Prepare necessary information: You'll need details like your turnover, business activity, bank account information, and company registration number.

- Online registration: Visit the HMRC website and complete the VAT registration form.

- Receive certificate: HMRC will review your application and, if it’s approved, send you a VAT registration certificate that contains your VAT number.

When is a business required to register for a VAT number?

You must register for VAT if:

- Your VAT-taxable turnover exceeds the current threshold of £90,000 in any 12-month period.

- You expect to exceed the threshold in the next 30 days.

- You take over a VAT-registered business.

What you need to register for VAT

- Business details: Legal entity, address, contact information.

- Bank details: For paying and receiving VAT refunds.

- Estimated turnover: Expected sales and purchases.

- Business activity: Nature of goods or services provided.

When you can't register online

In some cases, such as joining the Agricultural Flat Rate Scheme or registering a division of a corporate body, you may need to register using a paper form instead of the online system.

Verifying a VAT number

To verify a UK VAT number, you can use HMRC's VAT number verification service.

Just enter the VAT number into the HMRC tool to confirm its validity, which helps you to know whether your trading partners are VAT-registered, which protects you against fraud and ensures you’re complying with the rules.

Differences between VAT numbers and other registration numbers

When you’re running a business, there are lots of different registration numbers and it’s easy to get them confused. VAT numbers are distinct from other business identifiers like Company Registration numbers (CRN) and Unique Taxpayer Reference (UTR) numbers. A company registration number, issued by Companies House upon incorporation, is used to identify a business legally, whereas a VAT number is provided by HMRC specifically for tax purposes related to Value Added Tax. Similarly, a UTR number, assigned by HMRC, is used for income tax purposes and has nothing to do with VAT. Each of these numbers has a unique purpose and shouldn’t be confused with one another.

Obligations associated with VAT numbers

Having a VAT registration number comes with responsibilities. You need to:

- Charge the correct VAT rates: apply the right VAT rates to your goods or services.

- Keep accurate records: maintain detailed VAT records and invoices.

- Submit VAT Returns: file VAT Returns, typically every quarter.

- Pay VAT on time: ensure timely payment of the VAT owed to HMRC.

If you don't follow the regulations, you can be hit with penalties, fines, or interest charges.

If that all sounds complicated, remember that you can simplify your tax responsibilities by using a business account or tax service like ANNA. You’ll get reminders of all your deadlines, and you can even file your VAT from within the app.

Conclusion

Understanding VAT and your VAT registration number is important for any UK business. It not only ensures you’re complying with tax laws but also provides benefits like the opportunity to reclaim VAT and enhance the credibility of your business.

By familiarising yourself with the registration process and obligations, you can stay on top of your VAT responsibilities and focus on growing your business.

How ANNA can help you

At ANNA Money, we're all about simplifying financial management for businesses. We provide tools and services that help you handle VAT calculations, track expenses, and prepare your VAT Return. You can even file your VAT Return from your ANNA account. Our intuitive app ensures you stay on top of your VAT obligations without the hassle, so you can get on with what you do best - running your business.

Frequently asked questions

Can a business trade without a VAT Number?

Yes, if your business turnover is below the VAT threshold of £90,000, you can trade without registering for VAT. But you won't then be able to reclaim VAT on purchases or charge VAT on sales.

When do I need to use my VAT number?

Use your VAT number when issuing invoices,

How long does it take to get a VAT number?

It typically takes up to 30 days to receive your VAT registration certificate after applying, although it can sometimes take longer.

What are the consequences of not registering for a VAT number?

Failing to register when required can result in penalties based on the amount of VAT owed and the length of the delay. HMRC may also charge interest on unpaid VAT.

Can I check a VAT number online?

Yes, you can verify VAT numbers online using HMRC's VAT number checker or the EU's VIES system for EU VAT numbers.

Does the VAT number format differ between countries?

Yes, each country has its own VAT number format, usually starting with a country code followed by a series of digits or characters unique to that country.

How do I update my business details for my VAT registration?

You can update your details through your HMRC online account or by informing HMRC directly if certain changes occur, such as a change in business address or legal structure.

Can an individual have a VAT number, or is it only for businesses?

Sole traders and partnerships can register for VAT, so individuals running a business can have a VAT number. It's not exclusive to limited companies.

Do all countries have VAT numbers?

No, not all countries use VAT. Some countries have different sales tax systems, such as the Goods and Services Tax (GST) or no sales tax at all.

Read the latest updates

You may also like

Open a business account in minutes

![Offshore Company Registration in the UK [2026 Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_cdb14668f7/small_cover_3000_cdb14668f7.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![How to Check a UK VAT Number [Comprehensive Guide & Tips]](https://storage.googleapis.com/anna-website-cms-prod/small_a_Ewt17_NJE_Fa_PX_8u_L_Cover3000_Howtochecka_UKVAT_Number_5c361cc53b/small_a_Ewt17_NJE_Fa_PX_8u_L_Cover3000_Howtochecka_UKVAT_Number_5c361cc53b.webp)

![Can a UK Company Register for VAT in Ireland? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_Large_d5917ee7e3/small_Cover_Large_d5917ee7e3.webp)