Answers to some popular questions about the state of Making Tax Digital for VAT as of 2021.

What is Making Tax Digital?

Making Tax Digital (MTD) is a big part of the government's plans to make it easier for everyone to get their accounts right and keep on top of their bookkeeping. Phase 1 of MTD was introduced in April 2019 and required businesses to maintain digital records and send regular VAT Returns to HMRC using compatible software.

Making Tax Digital for VAT

VAT-registered businesses with a taxable turnover above the VAT threshold (£85,000) are now required to follow the Making Tax Digital rules by keeping digital records and using software to submit their VAT returns.

If you’re below the VAT threshold you can voluntarily join the Making Tax Digital service now. It’s worth getting ready for MTD, because after April 2022 VAT-registered businesses with a taxable turnover below £85,000 will be required to follow Making Tax digital rules for their first return starting on or after April 2022.

What are digital links for MTD?

When MTD was first introduced in April 2019, the focus was on digital records. That phase was launched successfully and phase 2 was given a soft introduction: the government gave businesses a year to make sure their systems were digitally linked. However, because of the pandemic, the deadline for the digital links mandate was extended to April 2021 – and that’s coming soon, so it’s best to be prepared.

So what exactly is a digital link? HMRC defines it as the “data transfer or exchange within and between software programs, applications or products that make up functional compatible software… must be digital where the information continues to form part of the digital records”.

What does that actually mean? It means a digital connection needs to be created between digital records and the VAT Return and between the VAT Return and HMRC to create a digital chain. In essence HMRC wants companies to create a digital audit trail that shows a clear journey from the digital record to the VAT Return data that is submitted to HMRC.

In practice, the rules on digital links are quite complex. You’re allowed to link cells in a spreadsheet, email a spreadsheet to be imported into another software product, automate data transfer or even just put the data on a memory stick and hand it to your accountant. But you cannot, for example, just copy and paste data from one place to another.

We’ll go into more detail on the specifics of digital links in another post.

Problems or opportunities?

In the short term, ensuring that all your VAT data is digitally linked may be frustrating and there may be a need for some companies to overhaul their systems, but in the long term there are opportunities. Businesses have the chance to streamline processes and get more accurate and trustworthy data. It also saves time – instead of having to manually calculate the 9 boxes on your VAT Return, it should all happen automatically.

The good news for ANNA customers is that we are working on being fully compliant with MTD phase 2 by April 2021.

Read the latest updates

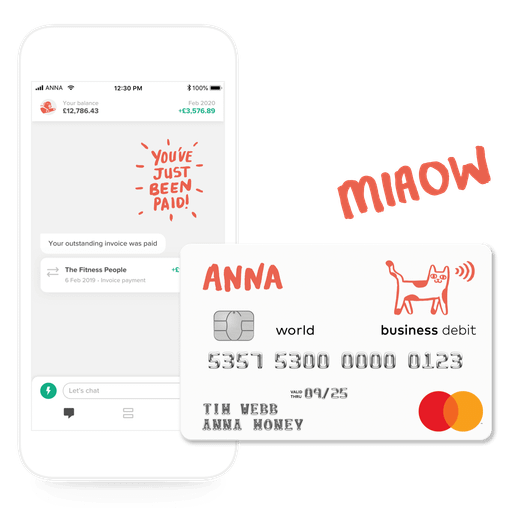

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)