How to Start a Property Development Business in 2026 [Definitive Guide]

Discover how to start a property development business in the UK, covering funding, permits, growth strategies, and market opportunities.

- In this article

- The thrill (and challenge) of the 2026 UK property market

- Laying the groundwork: Research, research, research

- Choosing your path: Residential, commercial, or both?

- Show Me the Money: Funding Your Project

- Making it official: Setting up your business (Without drowning in paperwork)

- Building your “A-team”: Architects, contractors, and more

- Overcoming red tape: Permits, approvals, and the dreaded delays

- Environmental compliance: It’s not just about being “green”

- Keeping projects on track: Management and risk mitigation

- The end game: Growth strategies and exit plans

- Conclusion

So, you’re dreaming of transforming old Victorian terraces into shiny new apartments – or maybe you’ve been eyeing that abandoned plot in a bustling city centre, imagining the chic flats or commercial units it could become.

If you’re nodding enthusiastically right now (and maybe picturing the profit potential too!), you’re in the right place.

The UK property scene is buzzing with opportunity, from regeneration zones in northern cities to commuter hotspots around London.

But before you dive in, there’s a lot to unpack: permits, financing, market research, and even environmental regulations.

This guide will walk you through every step of launching your property development business, so let’s start!

The thrill (and challenge) of the 2026 UK property market

The UK has always been a magnet for property investors, but there’s something special about 2026.

Government-backed regeneration projects are reshaping entire districts in cities like Manchester, Liverpool, and Leeds.

Meanwhile, the ongoing ripple effects of major infrastructure projects – like HS2 in the Midlands – are fueling a surge in demand for homes, offices, and commercial spaces.

Imagine walking through Digbeth in Birmingham: old factories are being converted into creative hubs, new blocks of affordable apartments are springing up, and trendy cafés seem to pop up on every street corner.

If you had bought a rundown unit there just a few years ago, chances are you’d be looking at a tidy profit today.

This blend of nostalgia (old industrial architecture) and modern flair (tech start-ups, co-working spaces) encapsulates the opportunities that property development brings – if you navigate it wisely.

Why 2026 is prime time for starting a property development business?

- Regeneration Galore: Many local councils are offering grants and incentives to encourage developers to breathe new life into forgotten neighborhoods.

- Strong Rental Demand: Young professionals and students flock to economic hubs, driving up rental yields.

- Low-Entry Barriers in Emerging Cities: Places like Stoke-on-Trent and Bradford remain relatively affordable but with potential for solid returns (Bradford’s rental yields can hit a juicy 12%!).

Laying the groundwork: Research, research, research

Before you start picking out flooring samples or drafting blueprints, you need to do your homework. And by homework, we mean serious market research.

Spotting the trends

It’s not enough to know that Manchester is “hot.” You’ll want to check official reports, study population growth, track rental yields, and keep an eye on housing supply.

Is there a new tram line being built? Has a major employer announced they’re setting up headquarters nearby? These developments can skyrocket property values practically overnight.

For example, Ancoats in Manchester was once an industrial ghost town dotted with empty mills. After a wave of creative businesses moved in (thanks to cheaper rents and council-driven regeneration), it transformed into a vibrant residential neighborhood with artisan bakeries and stylish loft apartments. Those who got in early reaped massive rewards.

Meeting local requirements

Market research doesn’t end with the numbers. The UK has complex planning regulations that vary from one local authority to another.

Make sure you’re clued up on whether your chosen site falls within a conservation area, has protected status, or is subject to height restrictions.

This knowledge can save you endless headaches (and money!) later on.

Choosing your path: Residential, commercial, or both?

Once your research confirms a promising location, it’s time to decide what you’re actually going to develop.

Are you envisioning sleek apartment blocks for young professionals? Renovated townhouses for growing families? Or maybe a mixed-use development with retail on the ground floor and flats above?

Residential gold rush

Residential projects often attract new developers because the demand for housing rarely wanes – especially in vibrant urban centres.

Converting a large Victorian terrace into multiple student apartments near a university (like the University of Leeds or the University of Liverpool) can be particularly profitable.

Commercial possibilities

Commercial projects – offices, retail outlets, warehouses – can deliver higher returns, but they also bring bigger risks. Securing tenants often depends on factors outside your control, like employment trends or market competition.

However, if you land a blue-chip client looking for a long-term lease, you’ll have a stable source of income for years.

In cities like Bristol or Glasgow, developers increasingly opt for mixed-use developments that offer the best of both worlds.

Picture a multi-story building with boutique shops or a co-working space on the lower floors and modern flats on the upper levels.

Not only do these developments create a self-contained community vibe, but they also diversify your risk.

Show Me the Money: Funding Your Project

No matter how brilliant your vision is, property development won’t get far without solid financing. Luckily, the UK offers a myriad of funding routes, from high-street banks to private equity firms and even crowdfunding platforms.

Traditional mortgages vs. Development finance

If you’re renovating a small property or buying an existing building, a standard mortgage might suffice. But for ground-up construction, specialised development finance is usually the name of the game.

Development loans are typically released in stages (or “drawdowns”) as you hit construction milestones, like completing the foundations or finishing the roof.

Short-term bridging

Let’s say you have discovered a potential gem: a rundown warehouse in Birmingham’s Jewellery Quarter that has enormous potential.

But you need the funds right now to secure the deal before someone else snaps it up.

That’s where you can use bridging loans.

They cover short-term gaps while you arrange more permanent financing (like a commercial mortgage or development finance).

Alternative funding

Want to think outside the bank?

Crowdfunding and peer-to-peer lending are on the rise.

If you can showcase a solid business plan (complete with timelines, cost estimates, and a compelling exit strategy) individual investors might be eager to pitch in.

It’s a great way to share risk and reward, although you’ll need to stay transparent and accountable to your many backers.

Making it official: Setting up your business (Without drowning in paperwork)

It’s surprisingly easy to register a new company in the UK – just fill out an online form on the Companies House website, pay a small fee, and voilà, you’re a bona fide Ltd. But choosing the right structure is trickier.

Sole trader, partnership, or Ltd.?

- Sole trader: You keep all the profits, but you’re also personally liable for any debts. Great for small-scale projects, but not so great for sleeping well if something goes wrong.

- Partnership: Shared responsibility and expertise, but also shared liability. Works best when you and your partner have complementary skills – say, one is a whiz at project management, the other at interior design.

- Limited Company (Ltd.): Offers protection for your personal assets and often appeals more to lenders. If you’re aiming for multiple projects or working with large sums, this structure can be a game-changer.

Pro tip

Many property developers opt for a limited company so that if one project hits a snag, their personal finances aren’t completely exposed.

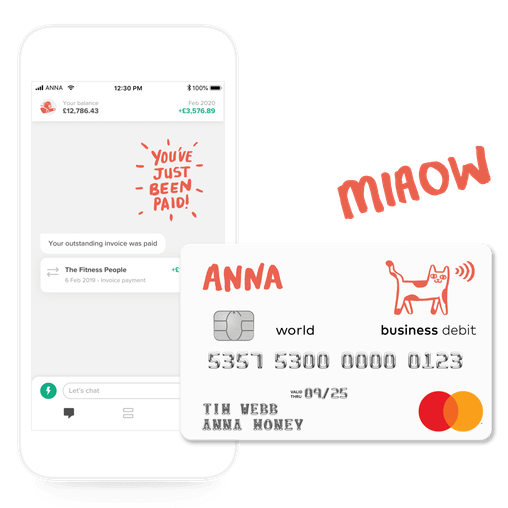

Here’s how ANNA can help you with registering a company while boosting your efficiency, reducing stress, and optimising your bottom line:

⚡Quick business setup and banking

ANNA lets you register a UK company for free and open a business current account in minutes, complete with a debit card to handle transactions effortlessly.

Whether you’re paying contractors, ordering supplies, or settling overheads, you’ll have a streamlined business finance experience at your fingertips.

⚡ Automated accounting and Tax management

From VAT returns to corporation tax preparation, ANNA’s automated tools ensure you stay on HMRC’s good side.

Meanwhile, built-in bookkeeping features help manage cash flow, payroll, and PAYE calculations, which is critical for juggling multiple development projects without letting compliance slip.

⚡ Smart expense handling

ANNA’s receipt-scanning feature automatically matches each purchase to the correct transaction category, making end-of-month reconciliation a breeze.

You can also set up bulk payments or direct debits for smooth, stress-free bill settling – vital when working with a rotating cast of contractors and suppliers.

⚡ Efficient invoicing and Cash flow

Send professional invoices in seconds, and let ANNA’s automated reminders nudge clients when payments are due. The Smart Tax Pots also help you set aside funds for future liabilities, so surprise tax bills won’t derail your project budget.

⚡ Round-the-clock customer support

With award-winning, Cardiff-based support available 24/7, help is always just a message away. Should any hiccups arise, like urgent payment issues or account queries, you can tackle them swiftly and get back to developing properties without missing a beat.

Building your “A-team”: Architects, contractors, and more

Property development isn’t a solo mission. You’ll need allies, advisors, and a few good folks who know how to pour concrete without toppling walls. Let’s talk about the dream team.

Architects and contractors

A visionary architect can transform a derelict site into a show-stopping development, while a solid contractor ensures that vision becomes reality, on time and within budget.

In the UK, contractors often carry certifications from bodies like the Federation of Master Builders (FMB) or the National House Building Council (NHBC), giving you a seal of quality.

Solicitors and accountants

Legal wranglings in property can get complicated, especially when you’re dealing with permits, contracts, and potential boundary disputes.

A solicitor with real estate experience is worth their weight in gold. As for accountants, they’re your financial compass. They’ll help structure deals to minimise tax exposure and keep track of multiple budgets, loans, and revenue streams.

Overcoming red tape: Permits, approvals, and the dreaded delays

If there’s one area that can give even seasoned developers sleepless nights, it’s navigating the UK’s planning and regulatory system.

Planning permission

Whether you’re building from scratch or converting an existing property, you’ll usually need to submit a detailed application to the local planning authority.

They’ll look at everything from the visual impact on the neighborhood to possible noise disturbances. In conservation areas (like parts of Bath or York), the rules can be even stricter to preserve historical character.

❗Common pitfall

You buy a property expecting to convert it into multiple flats, only to find the local authority won't approve your exact layout or you need specialised permits. Suddenly, your timeline (and budget) balloons.

Building regulations

Meeting building regulations is about safety, energy efficiency, and overall quality.

You might need sign-offs for everything from the thickness of the walls to the insulation material in your roof.

While it can feel like endless paperwork, remember that meeting these standards also boosts your property’s value and helps you avoid legal trouble down the line.

Environmental compliance: It’s not just about being “green”

Councils and communities are watching how new developments affect local ecosystems, water supply, and overall carbon footprints.

Mitigating your footprint

Installing solar panels, using energy-efficient windows, and sourcing eco-friendly building materials can do more than reduce your environmental impact; they can also make your property more attractive to buyers or tenants willing to pay a premium for sustainable living.

In Bristol (named the greenest city in England in 2024 due to its extensive green spaces, low annual emissions, and sustainable travel infrastructure), developers who integrate features like bike storage, communal gardens, and greywater recycling often command higher market prices. The eco-conscious crowd is growing, and they want homes that align with their values.

❗Common delays

Projects that risk disturbing protected habitats or waterways may need additional approvals.

If you’re redeveloping near a river or in a special conservation area, be prepared for longer review periods and more stringent environmental assessments. Factor these into your initial timeline to avoid nasty surprises.

Keeping projects on track: Management and risk mitigation

Effective project management can make or break your development. Gantt charts might not sound thrilling, but they give you a bird’s-eye view of each stage, from demolition and foundation work to electrical installations and final interior touches.

Timelines and budgets

It’s easy to dream big, but real-world construction often runs into delays: a shipment of materials might arrive late, or you might discover hidden structural damage in that “charming” Edwardian semi. Build contingency time (and funds) into your plans.

💡Key tip: Keep a 10–15% emergency fund for each project. That might feel like a hefty chunk of your budget, but it can save you from going under if unexpected costs pop up.

Communication Is everything

No matter how great your architect or contractor is, if lines of communication break down, costs can spiral.

Regular site visits, weekly progress reports, and open channels for quick problem-solving are essential.

Some developers swear by dedicated project management software to keep everyone aligned and others prefer old-fashioned checklists and phone calls. Whatever works, consistency is key.

The end game: Growth strategies and exit plans

So you’ve nailed your first project (congrats!). Now what?

Maybe you want to scale up to bigger developments, diversify into commercial properties, or replicate your success in a different region. Or perhaps you’re just keen to sell and pocket the profits.

Selling vs. Letting

- Selling: You can cash out after a successful project, reinvesting profits into bigger ventures or paying off loans.

- Letting: Holding onto properties provides ongoing rental income, which is fantastic for long-term wealth-building. This can also help fund future projects through refinancing.

Refinancing for growth

If you decide to keep your properties, you can leverage the increase in value after development or refurbishment.

Banks often let you refinance based on the new market value, which could free up the funds you need for your next big thing, like purchasing another plot in an up-and-coming Manchester district or that neglected warehouse in Liverpool’s Baltic Triangle.

Conclusion

Property development in the UK comes with thrilling opportunities and unavoidable challenges. Between scouting the perfect location, securing finance, managing contractors, and navigating regulations, it’s easy to get buried in admin, even before the first brick is laid.

But when your finances and compliance tasks are under control, you’re free to focus on bringing projects to life, from cosy residential refurbs to sprawling commercial builds.

That’s where ANNA Money makes a real difference for property developers.

Instead of battling with paperwork and juggling receipts, you can rely on ANNA’s streamlined setup: from free company registration to automated tax calculations and intuitive expense tracking.

You can pay your contractors and suppliers in seconds, send professional invoices with automatic follow-ups, and put aside tax funds without second-guessing your calculations and all through one user-friendly platform.

With real-time insights and round-the-clock support, ANNA takes the headaches out of day-to-day financial management.

And in an industry where delays and rising costs can quickly eat into profits, having your business and banking in harmony can be the edge that helps you thrive.

So, sign up today and see what else ANNA can do for you!

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)