How to Start a Dropshipping Business in the UK? [Actionable Guide]

Discover how to start a dropshipping business in UK with low overhead and no inventory & learn the steps to launch and grow your store.

Want to start a business with low overhead and no inventory to manage? Dropshipping might be your best bet. This guide will walk you through setting up a dropshipping business in the UK, from choosing your niche to staying compliant with UK laws.

Let’s break it down into clear, actionable steps.

What Is Dropshipping?

Dropshipping is a retail business model where you sell products without holding any stock. When someone places an order, it’s forwarded to a third-party supplier who ships it directly to the customer, often relying on a reliable courier service to fulfill the last mile

Your job? Pick the right products, run your online store, and market it effectively.

It’s low-risk, low-cost, and highly scalable – ideal for first-time entrepreneurs.

Why should you start dropshipping in the UK?

🔸 The UK has a booming eCommerce market, set to hit £150+ billion by 2027.

🔸 You don’t need a warehouse or upfront inventory costs.

🔸 Dropshipping is 100% legal in the UK and easy to start with the right setup.

🔸 There's less competition in niche markets compared to the US.

Step-by-step guide to starting a dropshipping business

1. Decide if dropshipping is right for you

Dropshipping is often promoted as a low-risk and easy way to enter eCommerce, but it’s not a hands-off business model.

Yes, you don’t need to manage stock or invest in warehouses – but you still carry full responsibility for the customer experience, from listing products to handling refunds.

This model suits people who are tech-savvy, customer-focused, and willing to test and adapt. You’ll need to work with digital tools like eCommerce platforms, payment processors, and advertising dashboards, and stay patient through trial and error.

It’s particularly suited to:

🔸 Entrepreneurs with limited upfront capital

🔸 People seeking flexible work-from-anywhere models

🔸 Sellers who are comfortable outsourcing logistics to vetted third-party suppliers

However, it may not be the right fit if you expect fast profits, have limited time, or prefer full control over product quality and delivery.

Your success depends on your ability to choose the right products, manage suppliers, and market effectively.

2. Choose a niche

The niche you select will influence everything from your product range to your marketing tone. However, if you choose a broad category like "home goods," it might seem smart at first, but it can lead to unfocused messaging and overwhelming competition.

Instead, narrowing down to a subcategory helps you stand out and target a specific audience more effectively.

📍Let’s say you’re interested in fitness. Instead of targeting all fitness enthusiasts, you could focus on home-friendly equipment for people with limited space, like resistance bands or foldable yoga mats. This allows you to write more targeted content and ads, speaking directly to your audience’s pain points.

How to actually find profitable products?

- To validate a niche, explore tools like Google Trends, eBay's trending searches, and TikTok Shop to see if there’s consistent interest over time.

- Cross-reference that demand with supplier availability on platforms like AliExpress, Spocket, or AutoDS.

Some examples of focused niches for the UK market include:

- Vegan skincare products for men

- Educational toys for toddlers

- Minimalist eco-friendly home storage solutions

Once you’ve chosen a niche, stick with it long enough to learn what works and what doesn’t. Constantly switching will only slow your growth.

3. Research competitors

Understanding your competition is vital if you want to create a store that stands out.

Before you launch, take time to analyse what other successful UK dropshipping businesses are doing.

This doesn't just mean browsing their websites – you’ll want to understand their product strategies, marketing techniques, and customer interactions:

- Begin by identifying the top players in your niche.

- Use tools like SimilarWeb or Koala Inspector to see how much traffic they get and what apps or integrations they're using.

- Facebook Ads Library and TikTok’s Ad Center can give you a clear picture of how they promote products.

While researching, take notes on the following:

🔸 Their best-selling products and pricing strategies

🔸 The tone and structure of their product pages

🔸 Customer reviews (look for consistent complaints or praise)

🔸 Return policies and shipping times

You’re not trying to copy their approach, but you’re trying to see where they succeed and where they fall short, so you can offer something better. Maybe they don’t offer fast delivery, or their support is slow – these are your opportunities.

4. Find reliable suppliers

The success of your dropshipping store depends heavily on your suppliers. If they deliver late, ship damaged products, or go out of stock frequently, your customers will blame you, not them. This makes supplier selection one of the most crucial steps in your business setup:

- Spocket is a top choice for UK-based suppliers with fast shipping.

- AutoDS helps automate inventory and connect to multiple suppliers from one dashboard.

- CJ Dropshipping is another option that offers global fulfillment centers, including some in the EU.

If you’re using AliExpress or Temu, be sure to filter by “Ships from UK” where possible. Always read product reviews, look at seller ratings, and test communication before making your first order.

📍 But, before selling any product:

- Order samples to test quality and delivery times

- Clarify return policies with the supplier.

- Ensure they offer tracking numbers and fast dispatch.

Building strong relationships with a few reliable suppliers will help you manage stock better and give your customers a smoother experience.

5. Choose products and set prices

Once you've chosen a niche and shortlisted suppliers, it’s time to pick products and price them strategically. Not every product that looks appealing will sell well.

Focus on those that solve a problem, create emotional appeal, or serve a specific need.

Products that are lightweight, non-breakable, and easy to describe clearly tend to perform best in a dropshipping environment. Avoid highly customised items or anything prone to returns (e.g., complex electronics or ill-fitting apparel).

When setting prices, consider the full cost:

- Base cost of the item

- Shipping fees

- Platform transaction fees (PayPal, Stripe, etc.)

- VAT if you’re registered

Then, add your profit margin, which is typically 20–30% for dropshipping.

📌Example: If a product costs £8 with £2 shipping, and platform fees are around £1, you’d need to charge at least £14.99 – £16.99 to maintain a viable margin while still being competitive.

Also, look at how competitors price similar items.

Aim to offer better value, whether that’s faster delivery, better photos, or clearer product information.

6. Build your online store

You have two options:

🔸 Build your own online store using platforms like Shopify or WooCommerce, or

🔸 List products on marketplaces like Amazon or eBay.

Each approach has its advantages, but for most UK dropshippers, owning your store offers more control over branding and customer experience.

Using platforms such as Shopify or WooCommerce allows you to:

- Customise the look and feel of your store.

- Use apps to automate order fulfillment and inventory tracking.

- Build email lists and create retargeting campaigns.

Your website should look professional and be optimised for both desktop and mobile users.

It must include clear product descriptions, customer reviews, secure checkout options, and trust signals such as SSL certificates and contact information.

Pages should load quickly and have intuitive navigation.

If you choose marketplaces like eBay or Amazon UK, you benefit from immediate access to a large audience, but you face higher fees and stricter selling rules. You also have less freedom to build a brand identity, so weigh the pros and cons carefully.

📍 Ultimately, building your own store gives you long-term growth potential, while marketplace selling can be a good starting point to validate products.

7. Register your business

To run a legal business in the UK, registration is essential. You’ll need to decide whether to operate as a sole trader or form a limited company. Both have pros and cons depending on your long-term goals.

🔸 A sole trader structure is simpler and faster to set up. You’ll only need to register with HMRC for self-assessment, and your business income will be taxed as personal income. This setup suits those starting out on a small scale.

🔸 A limited company, on the other hand, provides liability protection and may be more tax-efficient as your income grows. It also lends more credibility to your business, especially if you plan to work with corporate clients or expand internationally.

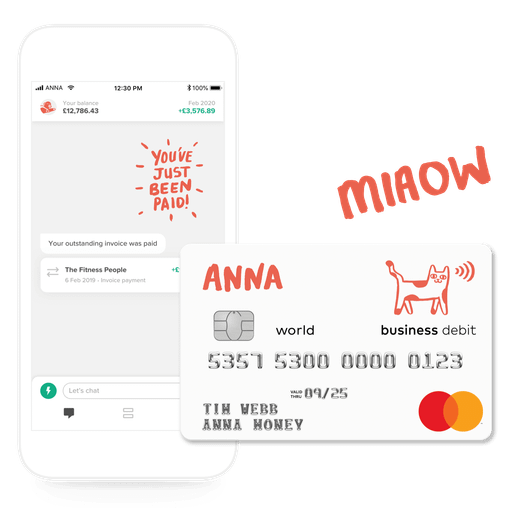

How to register your eCommerce business with ANNA

Setting up your eCommerce business in the UK has never been easier, especially when you register through ANNA. Not only is company registration quick and hassle-free, but it also comes with a suite of tools tailored for online sellers.

✅ Register your eCommerce business in 3 simple steps

- Start by checking the availability of your preferred business name.

- Provide a few basic details, and ANNA will handle the paperwork for you.

- Once approved by Companies House, you’ll get your incorporation documents and a fully functional ANNA business account.

➡️ Best of all? It’s free when you choose the Enhanced or Total support plan – saving you £50 upfront.

🔹 ANNA integrates directly with Shopify, WooCommerce, Amazon, Etsy, and eBay. This means all your sales data is automatically imported, organised, and used to calculate your taxes – no more spreadsheets or manual imports.

🔹 With the optional ANNA +Taxes add-on, your business stays compliant with HMRC from the very beginning. It automatically calculates and files:

- VAT returns

- Corporation tax

- PAYE

- Your annual Confirmation Statement

8. Set up finances

With your store and business registered, it’s time to separate personal and business finances. This isn’t just good practice –it’s essential for legal compliance and accurate tax reporting.

Start by opening a business account. For example, ANNA offers features designed specifically for small businesses and freelancers.

ANNA, in particular, includes invoicing, expense tracking, and automated tax notifications – all from one app.

You should also keep detailed records of:

- Sales and refunds

- Supplier payments

- Platform fees and advertising costs

For accounting, consider cloud-based tools like Xero, QuickBooks, or ANNA’s built-in +Taxes service. These platforms simplify VAT tracking, calculate Corporation Tax, and help file self-assessment or limited company accounts.

If your business grows quickly or involves multiple currencies, it’s worth consulting a qualified accountant. However, for lean startups, ANNA’s financial tools can efficiently handle most needs.

9. Understand VAT requirements

VAT (Value Added Tax) is one of the most complex areas for dropshippers in the UK, especially if you're working with international suppliers or shipping to customers abroad.

📌 You must register for VAT if your taxable turnover exceeds £90,000 within a rolling 12-month period. However, many businesses opt for voluntary registration earlier to reclaim input VAT on business expenses such as advertising and software subscriptions.

If you're VAT registered, you’ll need to:

- Include VAT in your product prices (typically 20% in the UK).

- Show VAT details clearly on customer invoices.

- Submit regular VAT returns to HMRC.

For cross-border dropshipping, the rules get trickier. Since 2021, if goods are shipped from outside the UK directly to UK customers, VAT must be charged at the point of sale. This means:

- You are responsible for collecting and remitting VAT, even if the product never touches UK soil.

- The VAT must be included in the final price the customer sees.

- When selling to customers in the EU, you may need to register for VAT in each destination country or use the EU One Stop Shop (OSS) scheme for simplified reporting.

10. Comply with UK Consumer and Data laws

Several consumer protection and data privacy regulations are in place to ensure fair trading, protect customer rights, and establish trust between businesses and consumers. Failing to meet these requirements can result in serious legal and financial consequences.

🔸 Under the Consumer Rights Act 2015, all products sold online must be:

- Described accurately on your website,

- Of satisfactory quality, and

- Fit for their intended purpose.

If an item turns out to be faulty or doesn't match its description, customers have the legal right to request a refund, replacement, or repair.

🔸 As a seller, you’re also obligated to offer a 14-day cooling-off period for online purchases. This means buyers can cancel and return their order for a full refund within 14 days of receiving the product, even if it’s not faulty. Refunds must then be processed promptly, usually within 14 days of the returned item being received.

🔸 In addition to consumer protections, data privacy laws under the UK General Data Protection Regulation (GDPR) require you to handle personal data responsibly. You must clearly communicate what data you collect (e.g., names, addresses, emails), why you're collecting it, and how you intend to use it. This is typically done through a detailed privacy policy on your website.

You must also:

- Obtain clear consent before collecting or using personal data for marketing purposes,

- Offer customers the option to opt out of marketing communications,

- Securely store customer data to prevent breaches,

- Respond promptly to requests from individuals who want to access, update, or delete their personal information.

🔸 To support enforcement, the Digital Markets, Competition and Consumers Act (2024) empowers the Competition and Markets Authority (CMA) to act against businesses that fail to comply. Penalties can reach up to 10% of your global turnover, so it’s essential to build compliance into your operations from the start.

Dropshipping business setup checklist – UK

🎯 Planning & Strategy

- Decide if dropshipping is the right model for your goals

- Choose a profitable niche with consistent demand

- Analyse competitors and note pricing, offers, and customer feedback

🔍 Product & Supplier selection

- Find reliable suppliers (e.g. Spocket, AutoDS, CJ Dropshipping)

- Order sample products to test quality and delivery

- Select products with low return rates and good margins

- Set pricing to include product cost, shipping, VAT, and fees

🛒 Store Setup

- Choose your platform: Shopify, WooCommerce, Wix, or marketplace Design a mobile-optimised store with secure checkout

- Add product descriptions, images, FAQs, and reviews

- Connect apps for inventory, automation, and analytics

🏢 Business registration & Finances

- Choose your business structure (Sole Trader or Limited Company)

- Register with HMRC and/or Companies House

- Open a business account (e.g., ANNA, Starling, Monzo)

- Set up bookkeeping with tools like Xero, QuickBooks, or ANNA +Taxes

📋 Legal compliance

- Check if you need to register for VAT (mandatory > £90,000)

- Include VAT in pricing and issue compliant invoices if registered

- Create Terms & Conditions, Returns Policy, and Privacy Policy

- Comply with Consumer Rights Act 2015 (e.g. 14-day cooling-off period)

- Ensure GDPR compliance (consent, data storage, access rights)

📢 Marketing & Growth

- Launch paid ads (Facebook, TikTok, Google Shopping)

- Start SEO with optimised product pages and blog content

- Set up email marketing (Mailchimp, Klaviyo) with cart recovery flows

- Collaborate with UK-based influencers or creators

- Use analytics tools to track performance and adjust strategy

Final thoughts

Starting a dropshipping business in the UK is one of the most accessible ways to enter the world of eCommerce. You don’t need a warehouse, a huge budget, or a full team. But you do need discipline, smart product choices, and a clear strategy.

Want to get started today? Begin by researching your niche and setting up your company with a tool like ANNA. With same–day company registration, you’ll be up and running in no time.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)