Discover how much it is to set up a limited company in the UK with clear insights on fees, services, and ongoing costs to plan confidently.

- In this article

- How much to set up a limited company in the UK - quick cost overview

- 1. The must-pay costs to get started

- Why have the costs of UK company registration changed recently?

- 2. Annual compliance costs for a limited company

- 3. Optional services that save time and hassle

- Final verdict: How much to set up a limited company in the UK?

- How can ANNA Money help you set up a limited company without breaking the bank?

- FAQ

Thinking of starting your own limited company in the UK?

It’s exciting until you realise you’re not quite sure how much it’s going to cost.

Between official registration fees, optional services, and those sneaky “extras” that pop up later, the price tag isn’t always obvious.

But knowing how much you need to set up a limited company doesn’t have to be a guessing game.

Read on to see what you can expect to pay so you can plan with confidence and avoid unwelcome surprises.

Let’s crunch the numbers!

How much to set up a limited company in the UK - quick cost overview

Setting up a limited company in the UK involves a range of costs primarily centred around government registration fees.

But it also includes additional optional fees for services that simplify the process and support ongoing business compliance. Here’s a quick breakdown of all the costs involved, from must-pay fees to optional extras.

1. The must-pay costs to get started

Before your new limited company can officially exist, there are a few unavoidable fees you’ll need to pay to get on the UK business map.

The cost of the standard registration fee that you pay directly to Company House depends on the following factors:

- The online fee is £50, with incorporation typically completed within 24 hours. This fee reflects a significant increase from older fees of £12-13 before 2024, and covers the official processing and registration on the statutory register.

- If you prefer to register via paper forms sent by post, the fee is £40. Processing is slower, often taking 8 to 10 days or more.

- For urgent incorporations, Companies House offers a same-day service at £78.

- Opening a bank account with one of the UK banks: Some UK banks offer free business accounts for a limited time, but the monthly fee price range varies significantly, making it hard to pinpoint the exact costs.

There’s a huge range of business bank accounts in the UK, but our top picks when it comes to limited companies, besides ANNA Money are Revolut and Tide.

Why have the costs of UK company registration changed recently?

The reason for the higher fees is to help make UK businesses more transparent, less prone to fraud and economic crime, and give Companies House the resources to modernise its services. That means better compliance checks, quicker processing, and stronger oversight.

It’s all part of changes brought in by the Economic Crime and Corporate Transparency Act 2023, which expanded Companies House’s powers and the information it can require from companies.

2. Annual compliance costs for a limited company

Once your company is up and running, there are a few regular tasks and their associated costs which you’ll need to budget for each year.

Skipping them can lead to penalties, so it’s worth building these into your financial plan from day one.

Confirmation Statement fees

Every year, companies must file a confirmation statement (previously known as an annual return). The fee is around £34 for online submission, and £62 via post.

With ANNA Money’s £49.90 one-off fee, you get confirmation statement filing and pay-as-you-go admin access.

Registered office address costs

A registered office address is legally required for official correspondence.

Many businesses use virtual office providers or formation agents offering this service. For example, with ANNA Money, you can make a £19.00 one-off payment +VAT, with Companies House fee included.

VAT registration & bookkeeping

While not directly tied to company formation, budgeting for bookkeeping, accounting, and VAT registration is important.

Small business bookkeeping can range from £800 to £1500 annually or more, depending on complexity.

VAT registration via a service provider might be a one-off fee of approximately £40 or bundled with accounting services.

💡 Did you know that with ANNA +Taxes subscription, you cover everything for £24 a month?

You get a VAT registration and access to business admin tools that manage your Payroll, VAT filing, and Corporation Tax.

3. Optional services that save time and hassle

Using a company formation agent in the UK simplifies, quickens, and smooths the process of setting up your limited company.

These agents guide you through the whole incorporation process, helping you avoid mistakes and offering extra services and support that you wouldn’t get if you just registered directly with Companies House.

Why use a company formation agent?

- Make things easy and fast: Forming a company can be tricky, but agents handle the paperwork for you, making sure everything’s filled out properly and submitted on time. This helps avoid delays or rejected applications, and many can set up your company within 24 hours or less.

- Expert guidance and advice: If you’re unsure about which company structure to choose or find the legal requirements confusing, formation agents explain everything clearly. They offer expert advice, which is especially helpful if you’re new to UK company law or have a more complex business situation.

- Additional services: Many agents go beyond just registering your company. They offer useful extras like a registered office address, ongoing secretarial help, assistance with preparing legal documents, help opening a business bank account, and support with compliance throughout the year.

🎁 Bonus: Top 5 company formation agents you should know about

To help you get started, here are our top picks.

For more options and detailed comparison, hop on to our blog, 10 Best Company Formation Agents to Consider.

Final verdict: How much to set up a limited company in the UK?

Providing an exact figure is near impossible because the costs really depend on your business type and what you need overall.

However, based on all the cost types we’ve covered, it’s safe to say that total costs can range between £1500 and £2500 for you to set up and initially run a UK limited company.

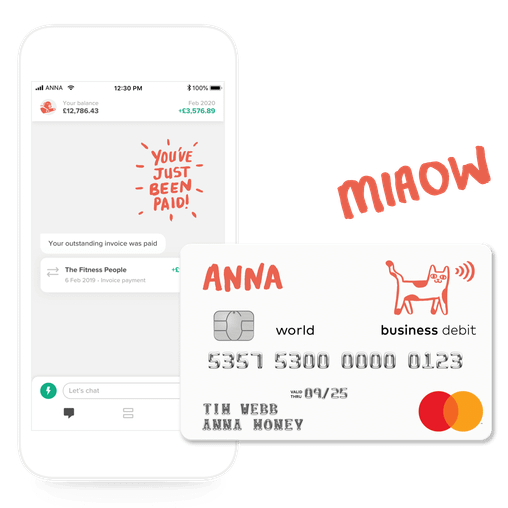

How can ANNA Money help you set up a limited company without breaking the bank?

ANNA Money UK offers an all-in-one platform that simplifies the process of setting up and running a limited company, making it especially suitable for small businesses and entrepreneurs.

What do we offer?

🔥 Open a mobile-friendly business account integrated with bookkeeping and tax tools to manage finances and stay compliant in under 10 minutes.

🔥 Simplify tax handling with our +Taxes service, which calculates liabilities, automates VAT, PAYE, and Corporation Tax calculations and filings.

🔥 Seamless compliance with HMRC regulations.

🔥 Virtual address registration.

🔥 Company name checker so you can see if your name is available to register at Companies House.

With ANNA Money, you can bundle a lot of usual fees and admin tasks into one simple package, making things easier to manage and saving both time and money.

Sign up today and start your company the smart way with ANNA Money.

FAQ

1. What documents do I need to open a limited company in the UK?

To open a limited company in the UK, you need to prepare and submit several key documents and details to Companies House as part of the incorporation process:

- Memorandum of Association,

- Articles of Association,

- Form IN01,

- Registered Office Address,

- Details of Directors and Persons with Significant Control (PSCs),

- Identity and Address Verification Documents.

Alternatively, you may use a company formation agent such as ANNA Money UK, which can assist with preparing and submitting these documents, identity verification, and offer ongoing compliance support.

2. Does a limited company need its own bank account?

Yes, a limited company needs its own bank account in the company’s name to handle all business transactions and money properly.

A UK limited company is a separate legal entity from its owners, so it is legally required to keep business finances separate from personal finances. HMRC also expects a clear separation for compliance and tax filing purposes.

With ANNA Money, you can open an account in under 10 minutes, no paperwork, no drama. We handle everyday bookkeeping, automatically sort your transactions and make VAT, expenses and tax returns way easier.

3. How long does it take to set up a limited company in the UK?

Setting up a limited company in the UK typically takes up to 24 hours if you register online directly through Companies House or via a company formation agent.

Most online applications are approved within one business day, allowing you to start trading shortly after registration.

However, if you opt for postal services, you’ll have to wait typically 8 to 10 days or more.

With a company formation agent such as ANNA Money, you can speed up the process and reduce the risk of rejected applications since we’ll verify your details before submission.

Read the latest updates

You may also like

Open a business account in minutes

![Offshore Company Registration in the UK [2026 Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_cdb14668f7/small_cover_3000_cdb14668f7.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![Limited Company Advantages and Disadvantages in UK [2025 Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_a_BP_3_Nv_Iq_R_Lda_Bz_Vh_limited_company_advantages_and_disadvantages_bab7f6b99f/small_a_BP_3_Nv_Iq_R_Lda_Bz_Vh_limited_company_advantages_and_disadvantages_bab7f6b99f.png)

![What's the Difference Between Public & Private Limited Company [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_7_Difference_Between_Public_and_Private_Limited_Company_Explained_7cb4a018ae/small_cover_3000_7_Difference_Between_Public_and_Private_Limited_Company_Explained_7cb4a018ae.webp)