If you’ve decided to go self employed, firstly – congratulations! Though it can be a daunting step if you’ve always been part of a team, or had a boss, it’s also a brave and exciting career move with endless possibilities for growth. (And theoretically, a very flexible start time.) But amid the freedom that comes with being your own boss, there is a framework and a few rules you’ll need to follow when you’re first setting up that’ll help you avoid financial pitfalls down the line. And who better to talk about them than someone who’s already taken the journey? We spoke to ANNA customer Jonathan McGookian, a multi-disciplinary behaviour specialist and founder of EVOLVE. He went self-employed under six months ago, and hasn’t looked back since.

Register ASAP with HMRC

Once you’ve decided to go self employed, your very first stop should be HMRC to register yourself as either a sole trader or a limited company. You have until 5 October in your second tax year (6 April the year you start to 5 April of the following year) to get registered. But as Jonathan can attest, it’s much easier in your first few months to get it done immediately. “We put feelers out for our new business in a rather tentative way, and no sooner had we done so, than we had a big contract ready to go, and had to set up the business simultaneously to starting to work with our first client. It wasn’t ideal.”

His solution was to go online and hire an accountant, and he encourages anyone with an existing client base to do the same. “Things like expenses aren’t black and white, especially in healthcare, and it really makes a world of difference to have a professional just tell you what needs to be done, especially if the idea of doing a self-assessment tax return while trying to run a business will put you over the edge.”

Once you go self-employed, it’s much easier to register with HMRC immediately.

Work out if you need to pay VAT

Registering for (and then paying!) VAT, or Value Added Tax, is a necessary evil for any sole trader or business owner earning above a certain income, and you can get to grips with the intricacies of the subject here. Don’t forget though, some industries - like healthcare for example - are exempt or partially exempt. Gov UK provides a lot of information, but Jonathan’s advice is once again to get an accountant. “You have more than enough to do in the first few months of your new business without teaching yourself to become a tax consultant as well.”

Open a business bank account

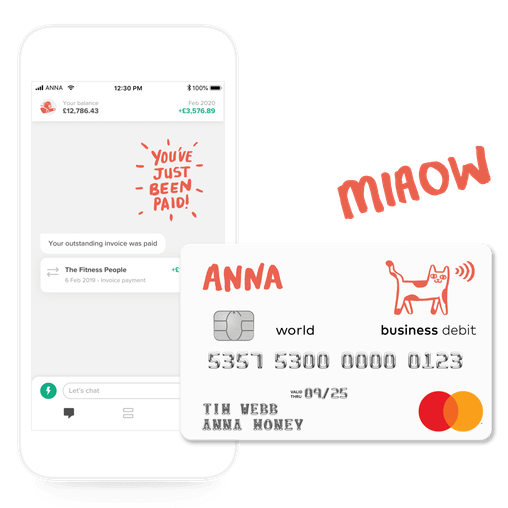

When the money starts coming in, your personal bank account won’t cut it - you need a specialised, dedicated business account. Having said that, the average high street bank doesn’t make it as easy as it could be. “I researched every major bank,” Jonathan recalls. “Each one had lengthy, complicated and restrictive processes for setting up a bank account. You had to physically go in and meet them, and fill in the paperwork within their time frames. Since we’d already started ‘trading’, it was a problem”.

With ANNA, it was different. “It was literally a few texts to set up a business bank account, and they even accepted a photo of my ID. The online customer service was great, in case I had questions, which I often did. Their response was on WhatsApp, and immediate,” Jonathan says. “I’d recommend never going with a traditional bank. Opening a new business is stressful enough without adding to it with loads more admin.”

Get the right insurance for you

Businesses dealing with clients will need insurance. After doing a lot of internet research, and comparing quotes, Jonathan advises finding a specialised insurance broker.

“We found a local broker who understood the healthcare system, and didn’t balk when we spoke about the occasional violence we sometimes are subjected to in caring for certain individuals with different needs. That was really helpful. We also realised that his expertise meant we could get much better deals than we’d found on online comparison sites.”

If that’s not affordable, it’s equally possible to do your own research. Just remember to do a lot of comparisons, as insurance companies vary their quotes far more than you’d expect.

Keep accurate financial records

Don’t get stuck in the cycle so many newly self employed people fall into – the big, terrifying pile of receipts that makes you dread the coming of April every single year. It’s easy to just shut your eyes and pretend it’s all going to be okay, but the best way to deal with your accounts is to either face them head on and keep meticulous records – or get some help. And that’s exactly what Jonathan did. “We were going down a really rad of receipt piles and dread, and then six weeks in, we signed up with ANNA. It was a huge weight off, knowing that when it came time to do our taxes, it wouldn’t be a nightmare.”

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)