Do you have to pay tax on clothes sold on Vinted, Depop or eBay?

The taxman is coming for online sellers who use marketplaces like Vinted, Depop, eBay and Etsy. So what do the new rules mean for you?

- In this article

- Side hustle or business?

- What the experts say

Side hustle or business?

The government has just announced new tax rules for anyone with a side hustle or hobby business, and it’s causing chaos – and some outrage – on social media as people try to work out if it will affect them.

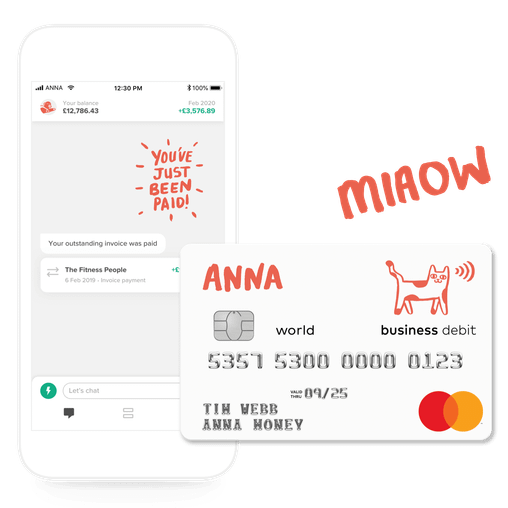

At ANNA we’re all about simplifying finance, so here are the headlines and what they mean.

- The reality is HMRC hasn't introduced any new ‘tax’ rules. What's new is that from 1 January 2024 online marketplaces now have to tell HMRC how much sellers are earning.

- This will only happen if you’re earning more than £1000 in profit (after fees) or selling more than 30 items a year.

- If you’re just selling personal items or selling things occasionally to make a bit of spare change, there’s need to do anything differently.

- But if you buy things to resell them, or make things with the intention of selling them for a profit, you’re likely to be ‘trading’ and you may have to pay tax on any profits that you make.

- If your earnings exceed £1,000 or your capital gains from selling high value items exceed £3,000 in a year, you may have to register for self-assessment tax if you haven't already.

What the experts say

Money Saving Expert Martin Lewis was quick to reassure people about the changes on X, commenting, ‘In brief, there is no new tax. Unless you’re ‘trading’, selling your old stuff isn’t taxed.’

Meanwhile Adam Jay, chief executive of second-hand clothes marketplace Vinted, told the BBC he didn’t think the new rules would affect many of the site’s sellers. ‘It’s actually quite a small proportion of users of our platform who will trigger this threshold where we need to provide information.’

HMRC hopes these new measures will clamp down on tax evasion, as people who sell online will be treated more like conventional businesses.

So what should you be doing to prepare for the new online selling rules? ‘It's crucial to stay informed and not succumb to panic on social media,’ warns ANNA’s accounting and tax expert Aftab Hussain. ‘Always make sure you have accurate record-keeping and get advice from a tax professional if unsure about your tax responsibilities.”

He continues: “If you have an ANNA business account or use ANNA +Taxes, filing a self-assessment can be a quick and stress-free ten-minute job – most of the work is already done for you. ANNA's tracking of your income and expenses really simplifies the process.”

If you have any questions about just how the rules might affect you? Ask our friend AI Tax Terrapin, who has already gobbled up all of HMRC’s information about these developments and can provide clear, jargon-free answers to your questions.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)