When you use your own car for business trips, you can claim some tax relief on the amount of fuel used. You can claim fuel expenses as a limited company through your corporation tax return, as a sole trader and self-employed individual through your Income Tax Self Assessment return and if you’re VAT registered, you can also claim back some VAT! This guide will take you through the different methods that HMRC allows a business to claim these types of expenses.

How much is tax relief on fuel as a limited company or sole trader?

You can claim tax relief by keeping a log of all business miles (outside of your usual journey to work, if applicable).

You’re allowed to claim 45p for each mile you use on a business trip. Once you have exceeded 10,000 miles of business related mileage claims, you can only claim 25p on each mile you use on a business trip.

The calculated amount can then be treated as a business expense for the company, and can be included in the calculation of a limited company’s taxable profits for corporation tax.

If you’re a sole trader, you can also use these rates and include it as tax relief and an allowable expense – calculated using the simplified expenses rules in your self assessment.

This rate is designed to cover both fuel and wear and tear on your vehicle, and is considered a simplified way to account for your motor and related expenses.

How to claim VAT relief on fuel if you are VAT registered?

Along with this tax relief, if your business is VAT registered, you can also claim VAT on the fuel used for business trips.

You have two ways to do this:

1. Claim VAT on fuel from business trips only

Only reclaim the VAT on fuel you use for business trips – you’ll have to keep detailed mileage records and calculate the amount of fuel cost and VAT related to your business trips. Here’s how it works: Step 1: You need to calculate the amount of miles used for business Step 2: Calculate fuel cost per mile (based on fuel receipt) Step 3: Then calculate the business trip cost and claim that in box 4 and 7 of your VAT return Miles used x per mile cost = cost of trip and VAT

For example: If mileage records show that:

- The total mileage is 1000

- Of which 500 is business mileage

- And the total cost of the fuel is £250

The cost of the all mileage from this fuel cost is £250/1000 miles = 25p per mile The business mileage is 25p x 500 miles = £125 inc VAT 125/6 (VAT fraction) = 20.83 VAT to be claimed

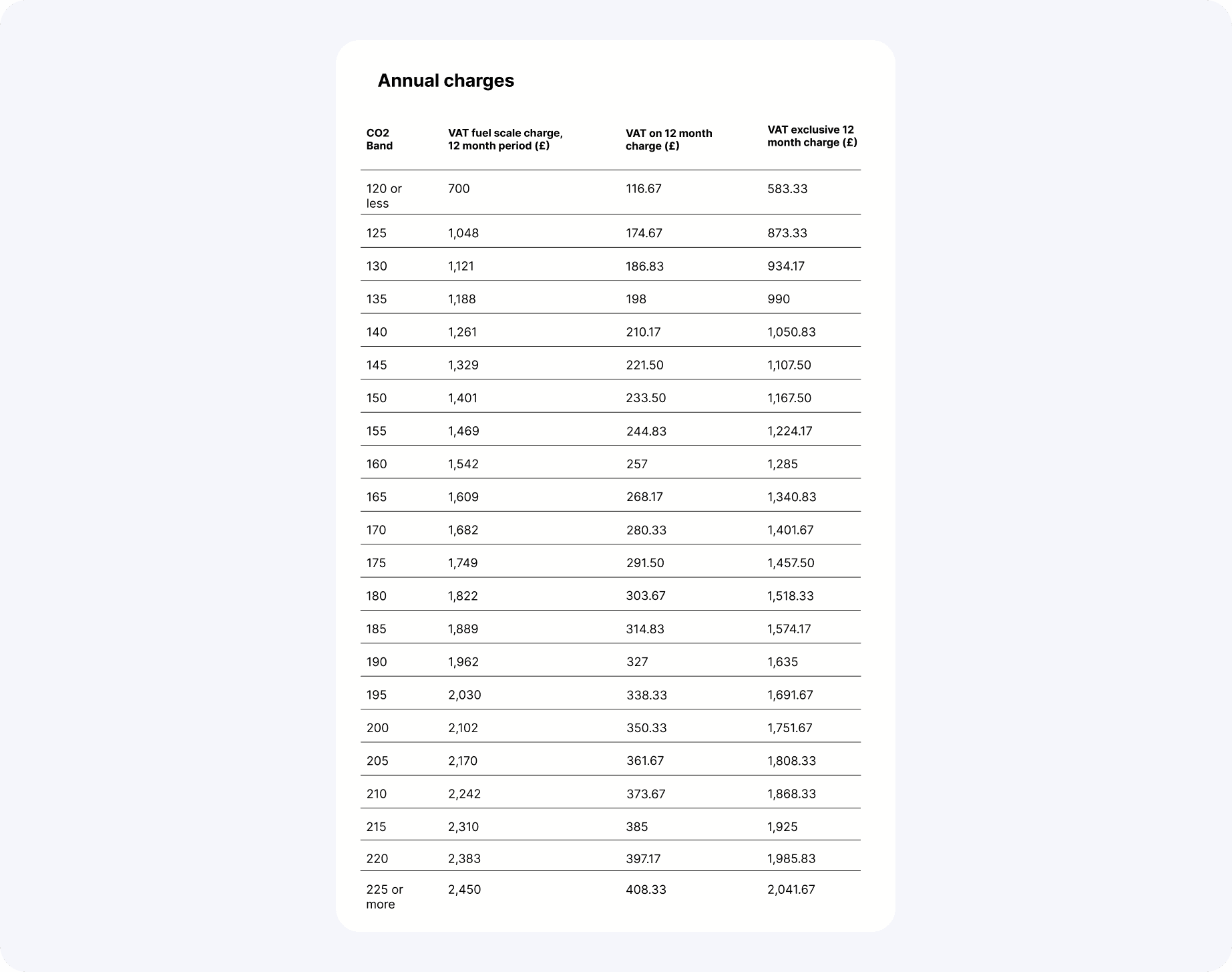

2. Fuel scale charge

Instead of calculating and proportioning VAT on fuel and business trips, you have the option to claim all the VAT on your fuel receipts (regardless of the fuel being used for business or personal reasons).

Then you need to pay a fuel scale charge to HMRC in your VAT return submission (which gets included in box 1 and 6). This charge is calculated based on the co2 emissions of your car and the tax period you're paying it in.

See the following table for VAT road fuel scale charges from 1 May 2022 to 30 April 2023:

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)

![How to Start a Self-Employed Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_fe5b6edef1/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_fe5b6edef1.webp)

![How to Start an Electrician Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268.webp)

![How to Start a Currency Exchange Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_daad2f9e2a/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_daad2f9e2a.webp)

![How to Start a Graphic Design Business in 2026 [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5.webp)