Did you use car or van finance before 2021? You might be owed thousands

Whether you are a florist, a dog walker or a builder, having a van is almost certainly an essential when it comes to running your business. And for most cash-strapped SME owners, using finance to buy a set of wheels is the only option.

But the world of car finance is now being investigated by the Financial Conduct Authority (FCA), which has concerns that the public may have been unfairly charged inflated interest rates on loans for both new and second hand vehicles.

- In this article

- Compensation may be available

- What was the issue with car finance?

- This might affect you if…

- The FCA investigation will NOT cover complaints where:

- Two cases where the complaints have been upheld

- How to lodge a complaint

- Be wary of claim management companies

- Remember that you can sometimes offset car finance against tax in certain cases

Compensation may be available

The FCA will look at whether a compensation scheme needs to be put in place in response to the alleged large-scale mis-selling in the £50-billion-a year motor finance sector.

The Guardian reports that in recent years, 80% to 90% of new cars – and an increasing number of used vehicles – have been bought with finance agreements, which include personal contract purchase (PCP) plans and hire purchase. Many involve the customer paying a deposit and a monthly fee with interest, before later deciding to either buy the car or swap to a different one.

In short, the investigation will potentially affect a lot of people and business owners. Consumer champion Martin Lewis has commented that it could lead to ‘the new PPI’ (referring to the multi-billion pound payment protection insurance scandal which rocked the industry a few years ago).

What was the issue with car finance?

Before January 2021, some car finance lenders had what is being described as ‘discretionary commission arrangements’ with brokers. This meant that brokers could adjust customers’ interest rates and that they earned more commission when rates were higher – so they were essentially being incentivised to give loans at the highest rates.

The FCA outlawed this practice in January 2021, but thousands have complained that they were overcharged before the ban and are calling for compensation.

This might affect you if…

- You bought a car under a finance scheme (such as hire purchase or personal contract purchase) before 28 January 2021.

- Your lender and car dealer (acting as a credit broker) had what's known as a 'discretionary commission arrangement' in place – where the higher the interest rate you were charged, the more commission the broker would get. You might not know if your broker and lender had a ‘discretionary commission’ agreement, but they should be able to tell you if you contact them.

The FCA investigation will NOT cover complaints where:

- You bought your car using car finance on or after 28 January 2021, after the commission contracts were banned.

- You have a car leasing agreement (also known as Personal Contract Hire).

- Your mis-selling claim doesn't centre on commission. For example, if it relates to affordability concerns where the dealership or finance company didn't check you could afford the loan.

Two cases where the complaints have been upheld

The Financial Ombudsman Service (FOS) recently ruled in favour of two consumers on the issue of unfair car finance, and this is what prompted the Financial Conduct Authority's (FCA) probe.

One of the rulings required Black Horse, part of Lloyds Banking Group, to pay compensation to “Mrs Y”, who took out a hire purchase agreement to buy a used car in 2016. Mrs Y paid 5.5% interest, but the agreement could have been set up with a 2.49% rate, according to the FOS.

The other ruling requires Barclays Partner Finance – part of the Barclays group – to pay compensation to “Miss L”, who took out a conditional sale agreement (similar to hire purchase) to buy a used car in 2018. Miss L paid 4.67% interest, but the agreement could have been set up at a rate of 2.68%.

Both of the FOS rulings stated that the divisions of UK banks involved “did not act fairly and reasonably” in their dealings with the customer.

How to lodge a complaint

First, dig out the paperwork you have for the deal and contact the firm that sold your car finance product. If you don’t already know, you might have to ask if your broker and lender had a ‘discretionary commission’ agreement.

Wait for them to respond and, if you're not satisfied, escalate your complaint to the Financial Ombudsman Service (FOS).

You may have to wait a while for a response though. The FCA has put a pause on the eight-week deadline for providers to get back to you while it investigates. So providers won't have to respond to your complaint about this sort of car finance arrangement until after 25 September 2024 at the earliest.

However, you do now have 15 months to take your complaint to the FOS after getting your final response. If your complaint is covered by these temporary complaint-handling rules, the business must tell you. Don’t forget to keep a record of any complaints you make, as this could be handy in the future.

MoneySavingExpert founder Martin Lewis is encouraging anyone affected to lodge a new complaint now, so it's in the queue for when any action is taken.

Be wary of claim management companies

Which? reports that it has already spotted paid social media ads from claims management firms seeking car finance clients. Which? says: ‘When PPI mis-selling first came to light, ads for claims management firms sprung up all over the media. If you use a claims management company, you'll give part of your payout to that firm if your claim is successful.’

Remember that you can sometimes offset car finance against tax in certain cases

While we’re talking about car finance, it seems timely to share a quick reminder that if you’re using a vehicle for your business and you bought it using a finance deal, you may be able to offset this against tax. For all the details just ask our smart, friendly Tax Terrapin – just copy and paste this question ‘If I have a car for my business that I bought using finance, can I offset tax against this?’

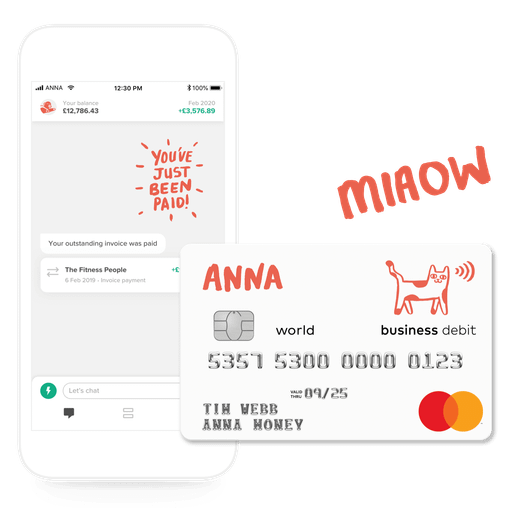

Open a business account in minutes