Taxes. Done for you by Auto Accountant.

Keep your books tidy, file taxes, and stay compliant - without lifting a finger.

- Connect your bank account

- Upload your documents

- Everything else happens automatically

In an age of self-driving cars, why are you doing your own accounting?

No one starts a business because they love paperwork, but lots of business owners still waste hours on admin, emails to accountants, and the dreaded last-minute tax panic. Accounting software is complicated. Accountants are expensive. And deadlines are stressful. Running a business shouldn’t mean running your own accounting department. That’s where ANNA comes in.

Try your new 24/7 accountant.

Auto Accountant is AI-based, HMRC-compliant, trusted by thousands of UK businesses and designed specifically for the UK tax system. And it’s available night and day.

ANNA has completely transformed how I manage my business finances. The automated bookkeeping saves me hours every week.

Finally, an accounting solution that actually understands small businesses. No jargon, no confusion, just clear automated tax filing.

I used to dread tax season. Now Auto Accountant handles everything automatically. Best business decision I’ve made.

How Auto Accountant works

Connect

Link your bank accounts and upload your documents, from quotes and invoices to receipts

Understand

ANNA categorises transactions, calculates VAT, and learns how your business works.

Run

Books, reports, tax estimates, and filings are updated automatically.

File

When deadlines arrive, everything is already prepared and good to go.

Why business owners use Auto Accountant

A fraction of traditional costs

Automation means paying less than traditional accounting.

Built for businesses, not accountants

No complex setup. No unnecessary features. Works out of the box.

No last-minute stress

Auto Accountant runs 24/7 - even during tax season.

No chasing your accountant

No calls. No emails. No waiting.

No messy paperwork

Everything is digital, organised, and searchable.

No missing out on savings

It’s always on top of changing tax rules.

What Auto Accountant does for you

Documents and books

Everything organised and up to date

Tax filing

Every deadline handled automatically

Payroll and PAYE

Everything organised for you

Invoicing and cash flow

Get paid and track every penny

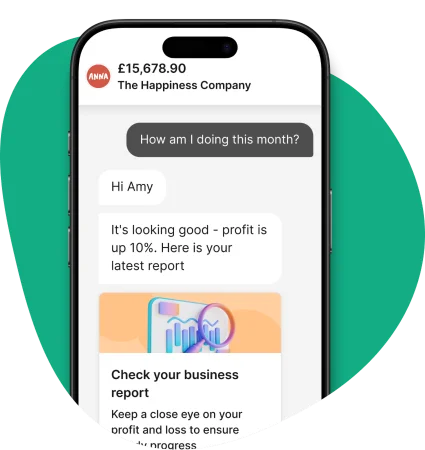

Just ask, anytime.

Don’t get charged every time you call your accountant for a chat. You get 24/7 access to Auto Accountant, whenever you need it.

Always know where your business stands

We tell you in plain English. Without the accounting jargon.

See your live profit

Get a real-time view of your business performance, updated continuously.

Know your tax position

Always know exactly what you owe and when it’s due - avoid nasty surprises!

Understand what you can spend

Make those important financial decisions with confidence, with live, accurate data.

Read the latest updates

Stop doing accounting. Start running your business.

Join thousands of businesses that have switched to fully automated finance. Connect your account and let Auto Accountant do the rest.

Get started for free

![How to Apply for More Time to File Your Company Accounts [+Pro Tips]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_How_to_apply_for_more_time_to_file_your_company_accounts_4fbc560852/small_cover_3000_How_to_apply_for_more_time_to_file_your_company_accounts_4fbc560852.webp)

![How to register for Corporation Tax in UK? [Step-by-step Guide]](https://storage.googleapis.com/anna-website-cms-prod/22391eac_9a5e_41e3_8d5a_61ccf331d395_2023_04_18_Corporation_tax_and_LTD_a9e5d074fa/22391eac_9a5e_41e3_8d5a_61ccf331d395_2023_04_18_Corporation_tax_and_LTD_a9e5d074fa.avif)