ANNA Salary Sacrifice Calculator

Our UK Salary Sacrifice Calculator shows how much tax and National Insurance you could save by popping more of your salary into your pension. It’s HMRC-approved, wallet-friendly, and a sneaky-smart way to grow your retirement fund and bump up your take-home pay. Try it now – no jargon, no hassle, just quick-fire numbers.

How much of my salary can I sacrifice to my pension?

Do I meet the current limit?

Salary sacrifice arrangements cannot reduce your pay below the National Minimum Wage (NMW) or National Living Wage (NLW) for your age group. HMRC rules require that your cash pay after salary sacrifice must still meet or exceed the legal hourly minimum.

Result & breakdown

| No salary sacrifice | Salary sacrifice | Difference | |

|---|---|---|---|

| Monthly | £3,750.00 | £3,750.00 | - |

| Salary sacrifice element | £0.00 | £187.50 | £187.50 |

| Taxable monthly pay | £3,750.00 | £3,562.50 | -£187.50 |

| Deductions: | |||

| Income tax | £540.50 | £503.00 | -£37.50 |

| Employee NIC | £216.20 | £201.20 | -£15.00 |

| Employee pension contribution | £129.20 | £0.00 | - |

| Total deductions | £756.70 | £704.20 | -£52.50 |

| Take home pay (net pay) | £2,864.10 | £2,858.30 | -£5.80 |

Annual summary

Based on: £45,000.00 salary | 5% sacrifice | 2% base pension (employer matched) | No NI sharing

What is salary sacrifice?

Salary sacrifice for pensions is an arrangement where you agree with your employer to reduce your gross salary by a set amount, and that amount is paid directly into your pension instead. Because the contribution is taken from your salary before Income Tax and National Insurance are calculated, you're taxed on a smaller amount. This means:

- You pay less Income Tax

The portion you sacrifice isn't counted as taxable income. - You pay less National Insurance

NI is also calculated on your reduced gross salary, so you keep more of your pay.

Example of a salary sacrifice scheme

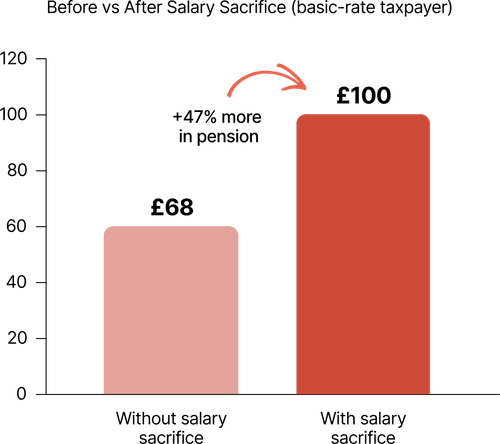

If you sacrifice £100 of gross salary, you don't lose £100 from your take-home pay – you lose less, because you save on the tax and NI you would have paid on that amount. Those savings effectively get added to your pension, boosting your retirement pot without costing you the full value from your net pay.

Without salary sacrifice, £100 gross salary shrinks to £68 after tax and NI, and you can't recover the NI if you contribute it to your pension. With salary sacrifice, the full £100 goes into your pension, but your take-home pay only falls by £68 – a 47% improvement in value for the same personal cost.

| Scenario | Gross salary amount | Income tax deducted | Nat insurance deducted | Take-home pay reduction | Pension Contribution | Effective boost |

|---|---|---|---|---|---|---|

| Without Salary Sacrifice | £100 | £20 | £12 | £100 gross → £68 net | £68 (net pay + tax relief) | - |

| With Salary Sacrifice | £100 | £0 | £0 | £68 net | £100 | +47% |

| Without Salary Sacrifice | With Salary Sacrifice | |

|---|---|---|

| Gross salary amount | £100 | £100 |

| Income tax deducted | £20 | £0 |

| Nat insurance deducted | £12 | £0 |

| Take-home pay reduction | £100 gross → £68 net | £68 net |

| Pension Contribution | £68 (net pay + tax relief) | £100 |

| Effective boost | - | +47% |

Benefits of salary sacrifice schemes

Benefits for employees

Lower Income Tax and National Insurance Contributions (NIC), tax-efficient pension savings.

Salary sacrifice can help employees keep more of their money while building their retirement savings. When part of your salary is redirected into your pension before tax is calculated, you pay less Income Tax and less National Insurance Contributions (NIC). This means your take-home pay is reduced by less than the amount going into your pension, giving you more pension for less cost.

Benefits for employers

Reduced NIC costs, employee retention, and a more attractive benefits package.

Employers also gain from offering salary sacrifice pension schemes. Since both employee and employer NIC are calculated on the reduced salary, the employer's NIC bill goes down. This saving can be kept to reduce costs, or it can be added to employees' pension contributions as an extra benefit.

Do your taxes in a tap

The effortless and cheapest way to run your books, file taxes, and stay compliant with HMRC

- Corporation tax

- Self assessment

- VAT return

- Real-time estimates

Frequently asked questions

Salary sacrifice trims down your gross salary, which can mean you pay a little less National Insurance. The good news? Your State Pension is based on how many qualifying years you've clocked up – not how much you've paid – so as long as your earnings stay above £6,396 a year (the Lower Earnings Limit for 2025/26), you're likely in the clear.

That said, benefits like statutory maternity pay or life cover – anything based on your salary – might use the reduced figure. Best shout: check with your HR team to see how it shakes out.

Look out for a line that says "salary sacrifice" or "pension sacrifice" – that's your clue. It'll show up as a deduction before your tax and National Insurance are calculated. You'll also spot your employer's pension contribution (which includes your sacrificed amount) in a separate section.

The end result? Less tax and NI now, more pension magic later.

You can. It's not a forever thing. Just let your employer or payroll team know you want to opt out or change your contribution. Bear in mind: tweaks usually kick in from the start of a new pay period, and may involve a bit of admin.

It depends where you sit on the payscale. If salary sacrifice would drop your take-home pay below the National Minimum Wage or National Living Wage, your employer probably won't allow it.

But if you're earning comfortably above that line, it can be a savvy move – you save on tax and National Insurance, which means more pension bang for your buck. Just note: if you're earning below the personal allowance (£12,570 in 2025/26), you might not see much of a tax break.

Sort of. Salary sacrifice lowers your gross pay, which means your student loan repayments – based on your post-sacrifice salary – might shrink a bit. You'll pay a little less each month, but interest keeps building, so it's more of a delay than a discount.

Most are – even part-time folks – as long as your salary doesn't dip below the legal minimum after the sacrifice. Some employers might have extra rules, like waiting until after your probation period. It's always best to check the fine print with your company.

Once you leave, your salary sacrifice agreement ends with your job. But don't worry – your pension stays put in your pension pot, ready for your next adventure. Any non-pension perks (like a company car or childcare vouchers) will stop too.

Depends on your employer. Many only allow changes once or twice a year – like during annual reviews or big life moments (think weddings, babies, that kind of thing). Some are more flexible, but you'll likely need to put it in writing.

There's no official HMRC cap, but common sense (and a few rules) apply. You can't sacrifice so much that your pay drops below minimum wage, and pension contributions are still subject to the annual allowance (£60,000 for most people in 2025/26). Also worth remembering: slashing your salary too much might affect things like mortgage applications or life insurance.