One place for all your business accounting

Save time and money on your business accounting with ANNA +Taxes

Try for freeLearn moreWhat you get with ANNA +Taxes

All your taxes covered: Payroll, VAT filing and Corporation Tax

Including everything you need to register a new business and get a confirmation statement. So you get started knowing you’ve ticked all HMRC’s boxes

Try for free

Register for VAT, Payroll and Corporation Tax according to your business needs

Auto calculate and file VAT, Corporation Tax and PAYE with ease

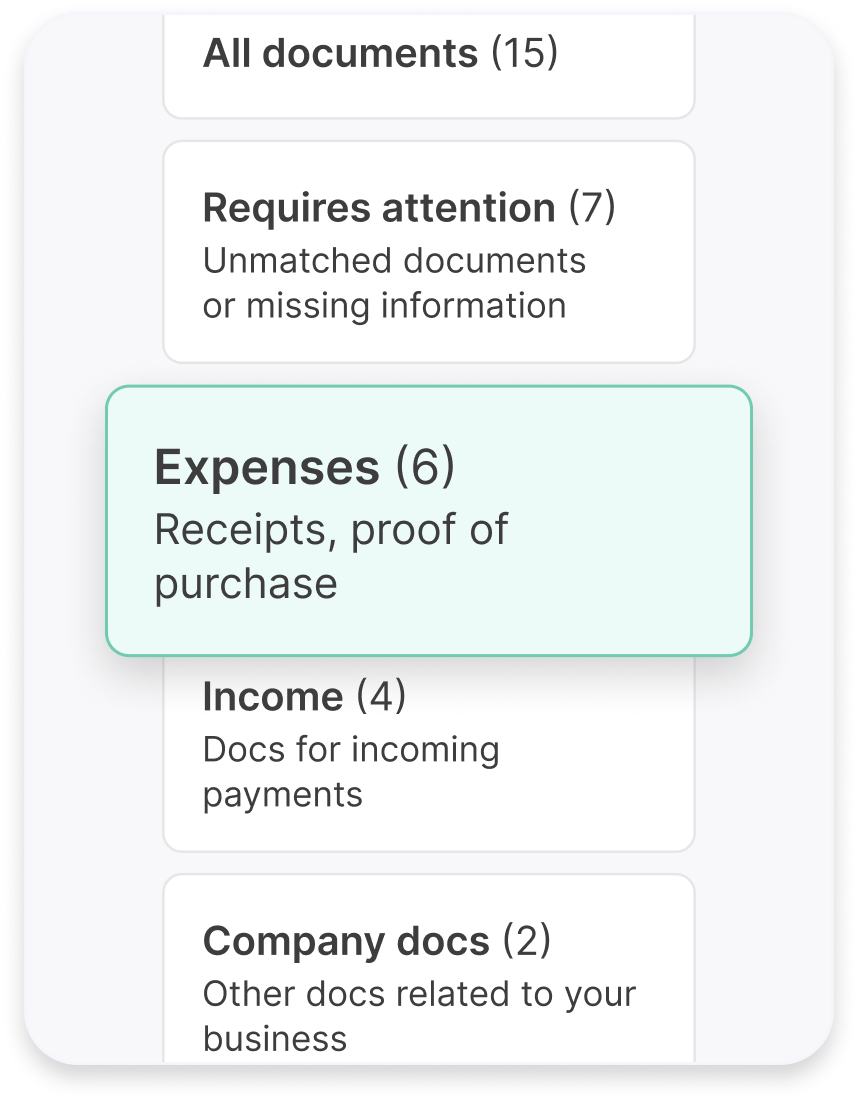

Claim more expenses and lower your tax bills with automatic expense sorting

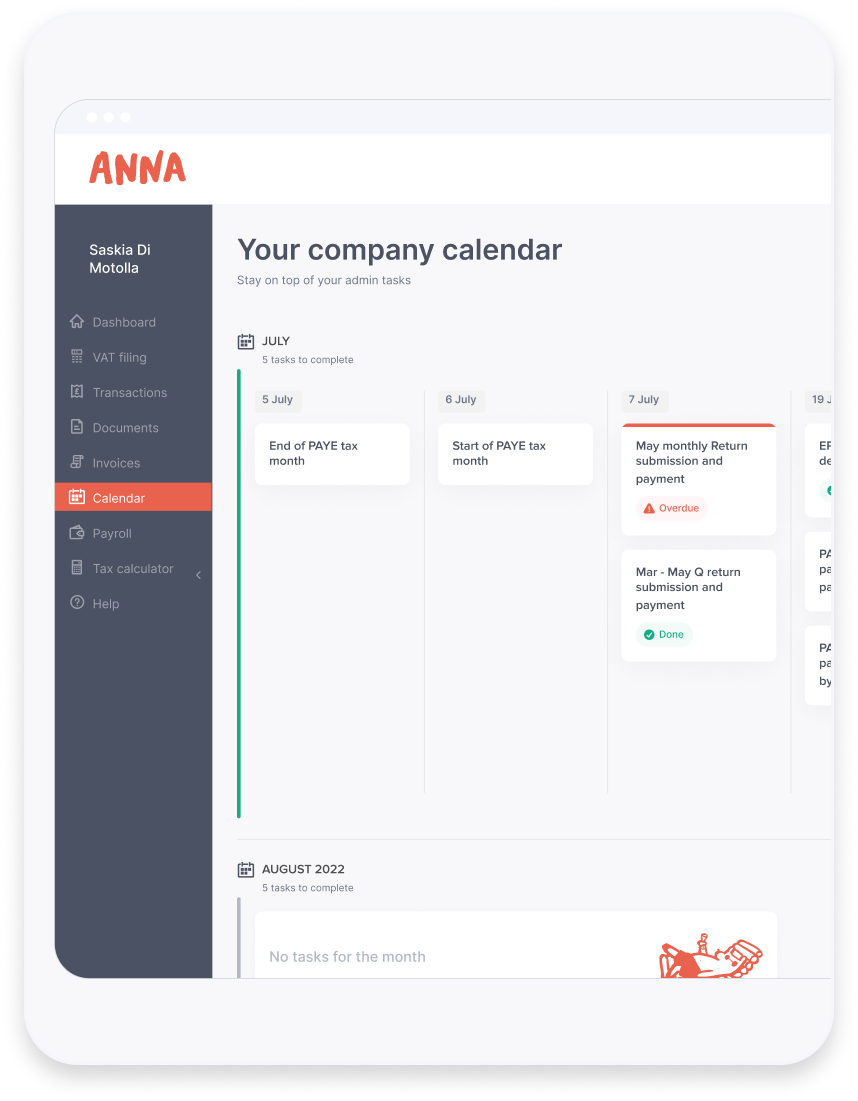

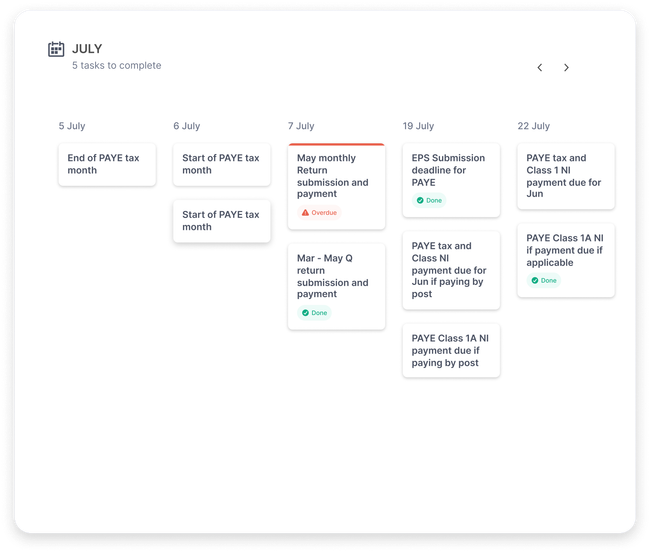

Personalised tax calendar so you don't miss deadlines

File taxes from ANNA if you’re in your first year of trading and keep your filing records in one place

Smart

receipt scanner

Snap a receipt of a business purchase and it’s automatically matched to a transaction in your business account. Then it’s categorised and used to calculate your taxes

Reserve money

for taxes

With Pots, every time your business is paid a portion of the money is automatically put aside to cover upcoming tax payments

Your tax questions answered

by our AI Tax Bot

Got a tax question? Ask Tax Terrapin, ANNA’s ChatGPT-powered taxbot. Not only can it answer your questions, it links to the relevant HMRC documentation

VAT return, Payroll and Corporation Tax

Help with your VAT and more

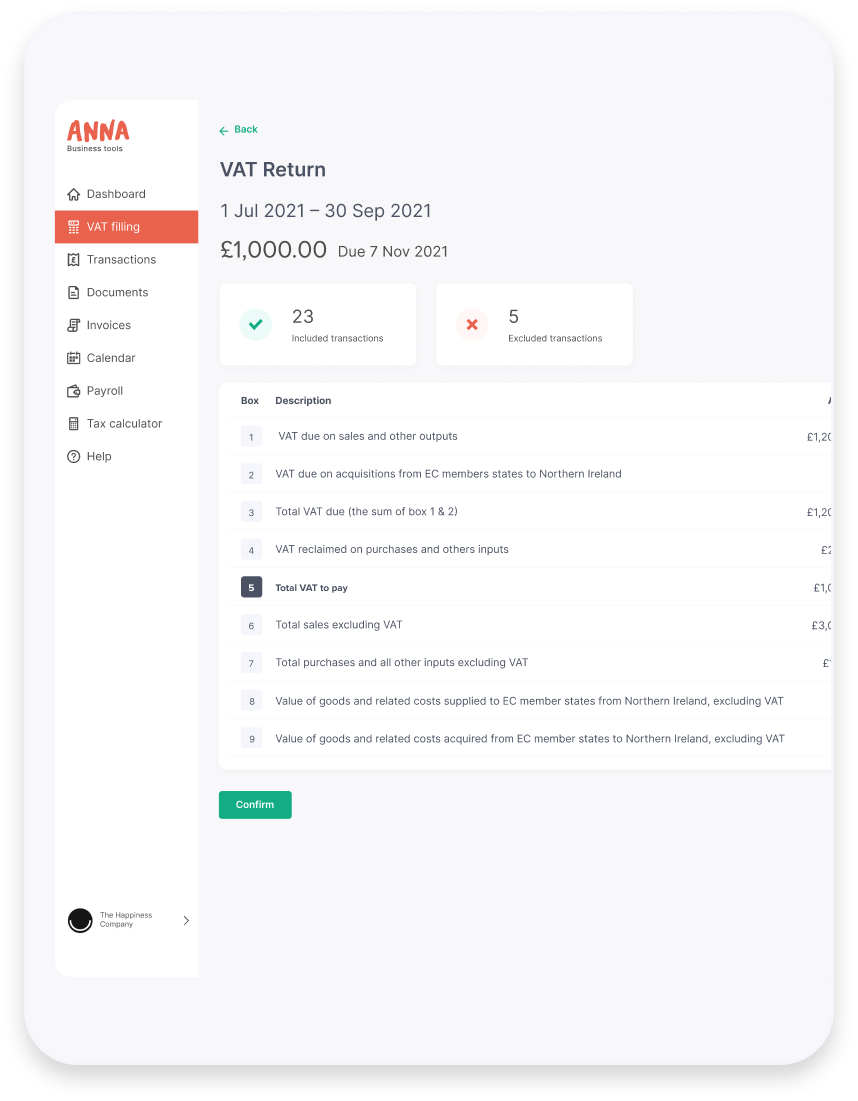

Get registered for VAT and have it calculated and filed through ANNA. Personalised reminders mean you never miss a deadline, and VAT Pots mean money is automatically put aside for your VAT Return

More about VAT with ANNA

The right way to pay yourself

ANNA +Taxes calculates payroll for your limited company so you don’t have to hire an accountant or do it yourself

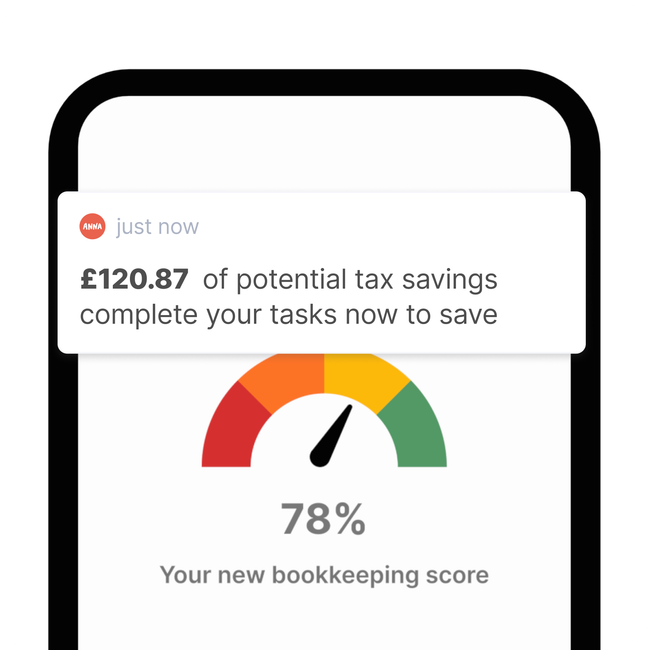

Stay on top of your books

Bookkeeping Score gives you quick, simple tasks to keep your books tidy. Keep aiming for that perfect score!

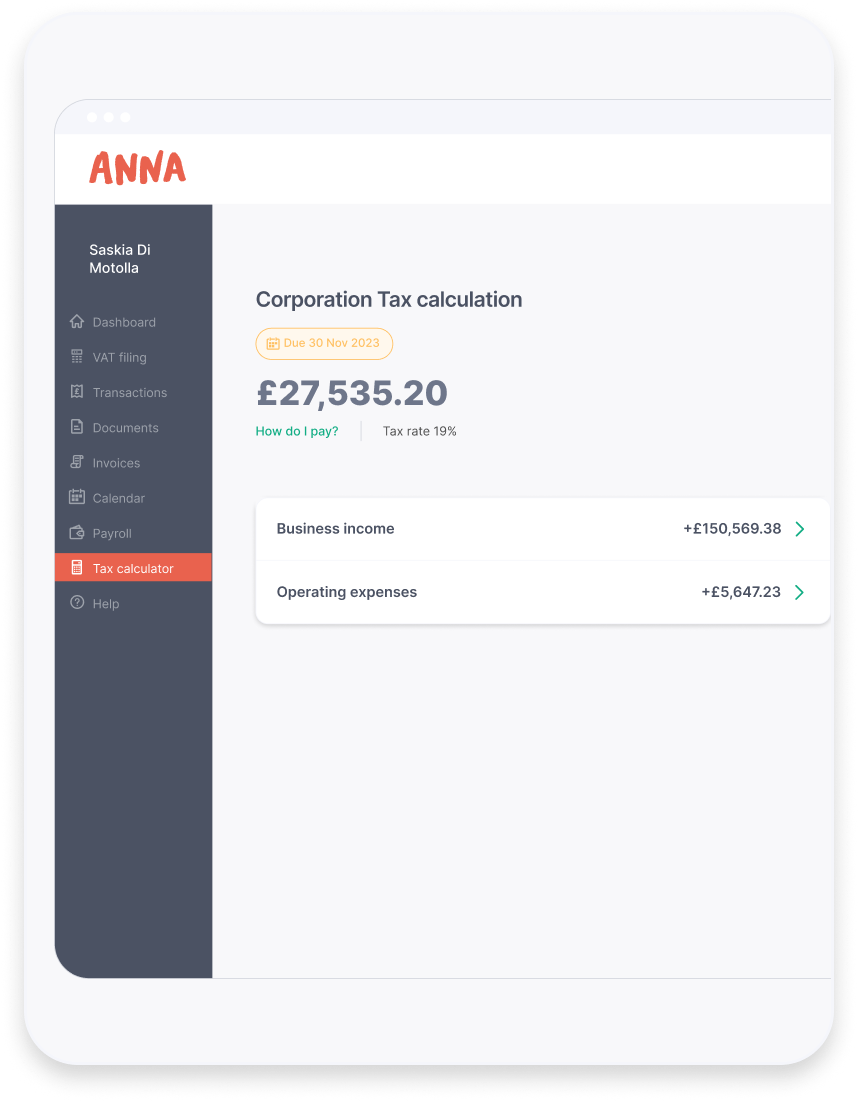

Know your Corporate Tax

ANNA +Taxes will help you register your company for Corporation Tax, calculate how much you owe and make sure you meet the deadlines

Bookkeeping score

Save money on your taxes with Bookkeeping Score

Bookkeeping Score lets you know how tidy your books are and gives you simple tasks (like making sure expenses are correctly categorised) to make your business as tax efficient as possible. The higher your score – the more tax you could be saving!

Tax year dates

Don’t miss your tax deadlines

No need to put the important dates into your calendar or hope for a nudge from an accountant – ANNA will remind you ahead of time and help you get prepared

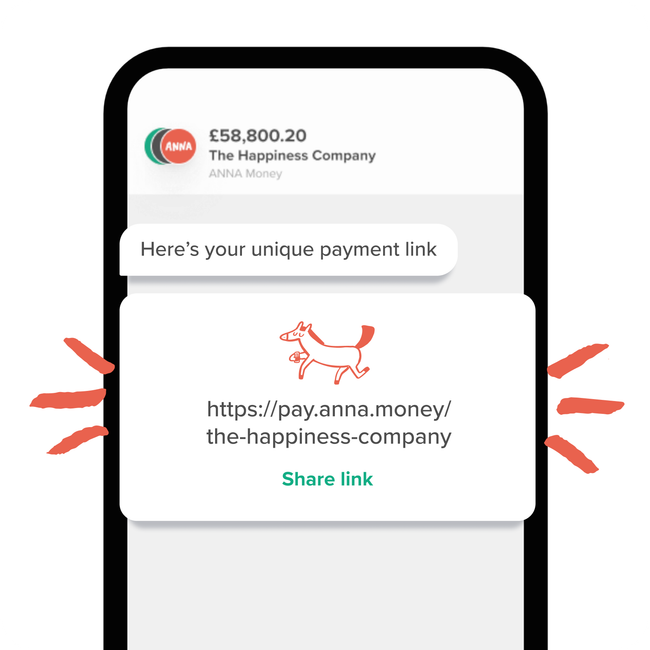

Accept payments

Get paid easily

With ANNA +Taxes you get a professional invoice generator to create and send invoices tailored to your business. You also get a unique payment link so clients can pay you online, using QR codes or through the Stripe payment platform

How much is +Taxes?

Cover all of your taxes with a single subscription

For the first 3 months ANNA +Taxes is just £3 per month, so you have time to try it properly before moving onto the full-price payment plan. It’s then £24 a month +VAT after that

See all business tools packagesAuto-calculate VAT, Corporation Tax and PAYE with ease

Filing for Corporation Tax and Annual Accounts – if you’re in your first year of trading

Automated expense sorting and Pots transfers help you put tax money aside

Tools to minimise taxes and boost expense claims

Personalised tax calendar – never miss a deadline again

Automated VAT Return calculations and direct filing with HMRC

Unlimited XLS VAT filing

Exportable Profit/Loss, balance sheet, income statement

Payroll

Bookkeeping Score – helps you keep your books tidy

Chat with our experts 24/7 anytime

Invoicing with card payments accepted

Sign up for ANNA +Taxes

Get full tax support

Ready to sign up for ANNA +Taxes?We’ll need some basic information about your business and tax records Sign up takes about 10 minutes, or even less if you already have an ANNA business account

Try for free