VAT calculation and filing

Smart VAT at your fingertips

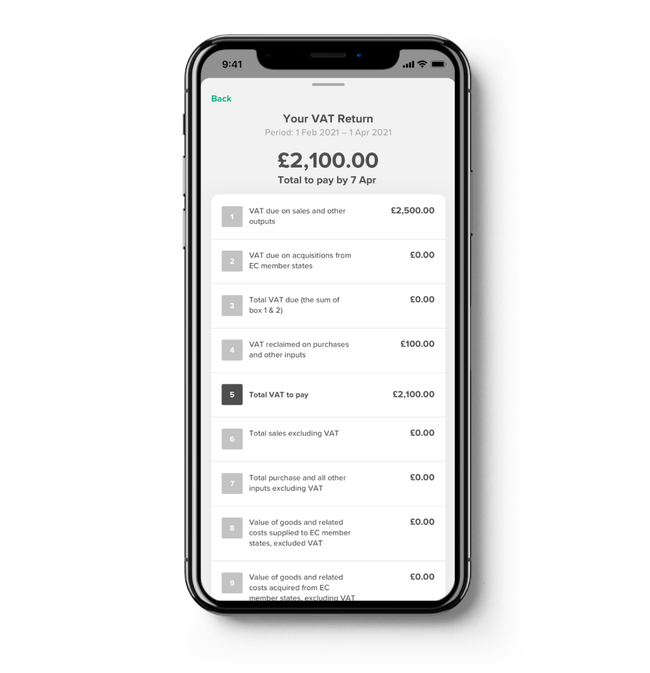

ANNA’s automated VAT service makes for easy VAT Returns. They’re created automatically from your receipts, sales and invoices and are ready to file with HMRC at the tap of a button.

Get started

Already registered? Log in

Automatic VAT from receipts

When you take a photo of a receipt ANNA automatically scans it and identifies the VAT, making it simple to claim everything back. You can even forward your digital receipts by email and ANNA will log the VAT for you.

Sales VAT sorted

When sales pop into your account (ker-ching!) ANNA will automatically add the VAT to your VAT Return. It’s a great start to calculating what you owe.

All organised

Your expenses are automatically categorised. Which means it’s easy to organise your VAT Returns the right way – that’s super handy if you’re new to VAT.

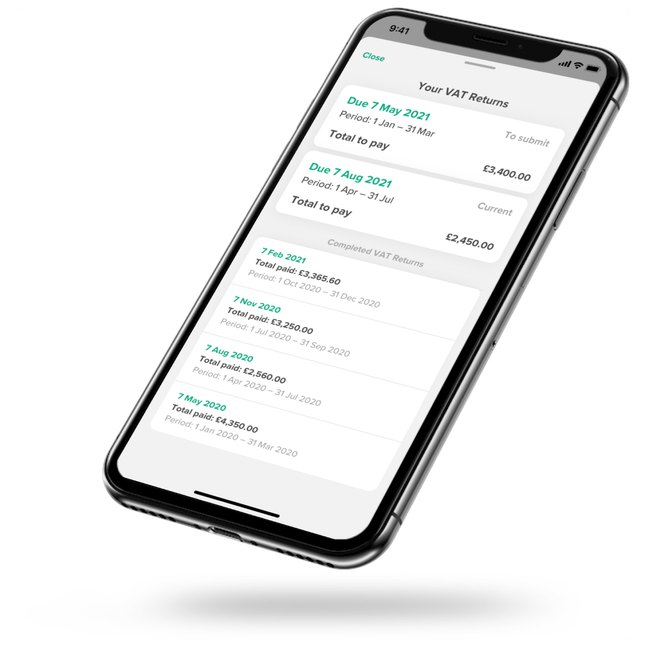

MTD compliant

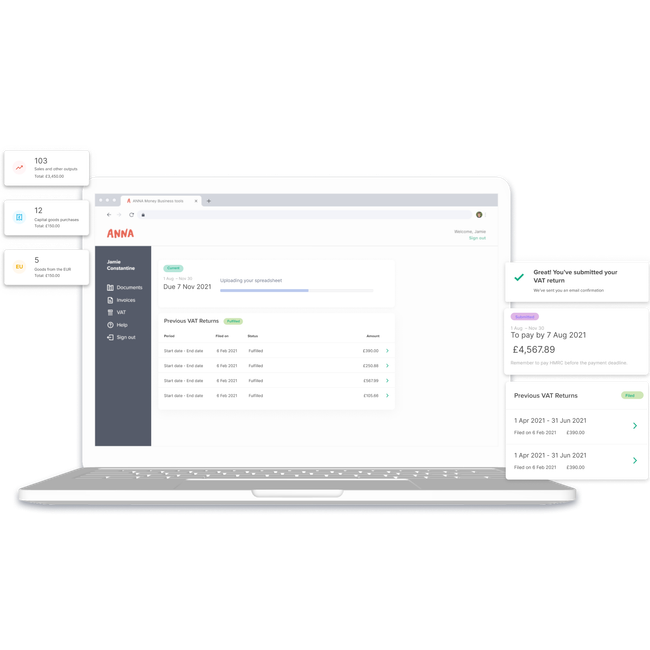

ANNA lets you file your VAT directly with HMRC and is all set up for Making Tax Digital (MTD). You even get reminders of when your VAT Returns are due, so you’ll never miss a deadline.

Upgrade from sheets

No more calculating your VAT in a spreadsheet. Try ANNA’s automated VAT service in the app and save yourself oodles of time.

Tailored for your VAT scheme

ANNA makes VAT easy whether you’re on the Flat Rate VAT Scheme or Standard VAT Scheme.

The reviews are in

Automate your VAT Return calculation

You can set up ANNA Business Tools in a jiffy, and then you’ll be ready to file VAT Returns, do your bookkeeping, send invoices and store your documents with our MTD-friendly set of tools recognised by HMRC.

Start free trial

Need a business account? Sign up for one with ANNA