Compare our pricing plans

What you pay depends on your business

Our plans start at £0 per month – you only pay for the services you use. Whatever your plan, if you don't use your account for a month, you don't pay the monthly fee for that month

Get an ANNA Account

Send professional invoices

Create, send and chase professional-looking invoices

Sort your expenses

Snap receipts and ANNA matches them to transactions on the go

Give your accountant access

Give your accountant realtime access to your sales and expenses

Manage multiple cards

Give co-workers their own ANNA debit card and stay on top of expenses

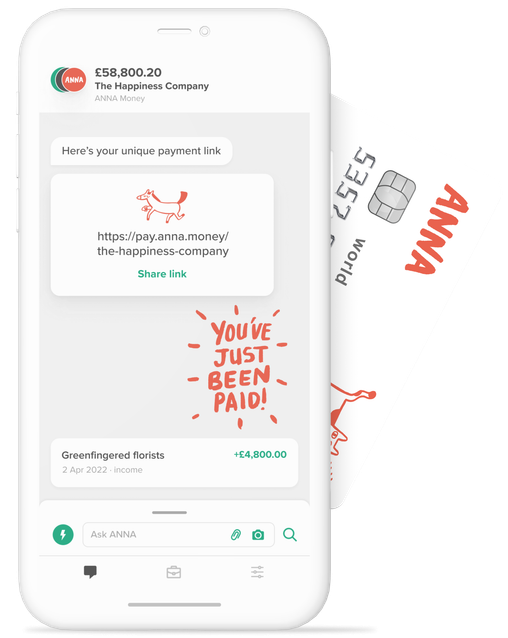

Your own payment link

Get paid straight away, without having your account details

Direct Debits

You can set up Direct Debits at no extra charge – whatever your pricing plan

Schedule regular payments

Set up a scheduled payment and ANNA will send it when the time comes

Payroll on the go

Make bulk payments so you can pay all your employees in one go. Ta-dah!

Customer support without the wait

Award-winning,

24 hour

customer support

0m 38 seconds

Current wait time to chat to a human

Sign up in a matter of minutes

Enter your email to sign up

Download the ANNA app

Answer a few simple questions about your business

Complete your application in less than 10 minutes

The reviews are in