Receipt Scanner

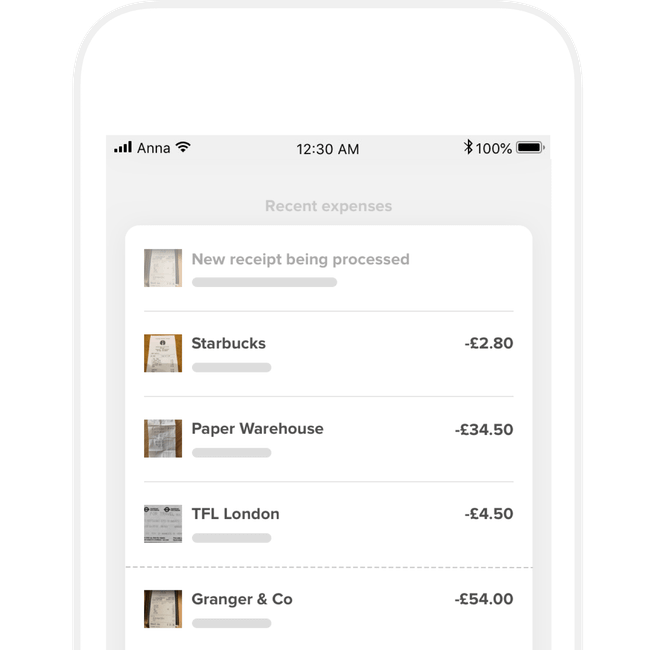

Bye-bye, paper receipts

Piles of receipts keeping you awake at night? ANNA snaps and sorts them on the go, saving you the time and hassle.

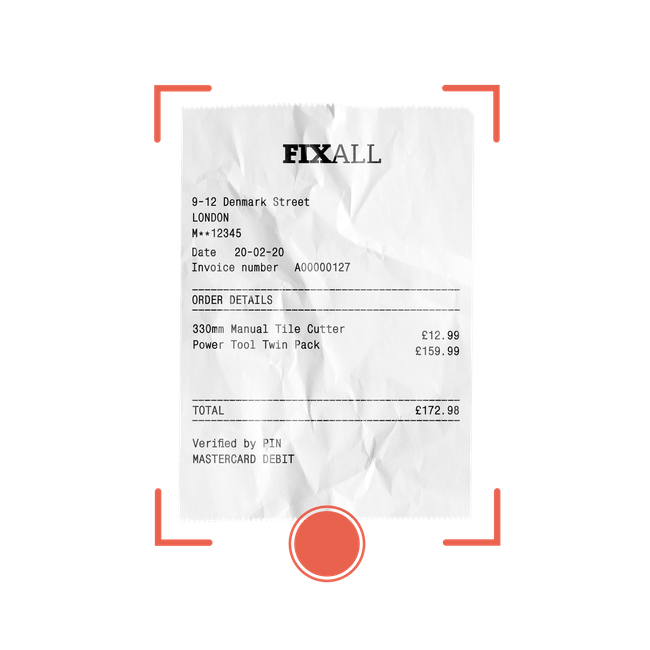

Snap it

Record your expenses on the go with instant receipt capture

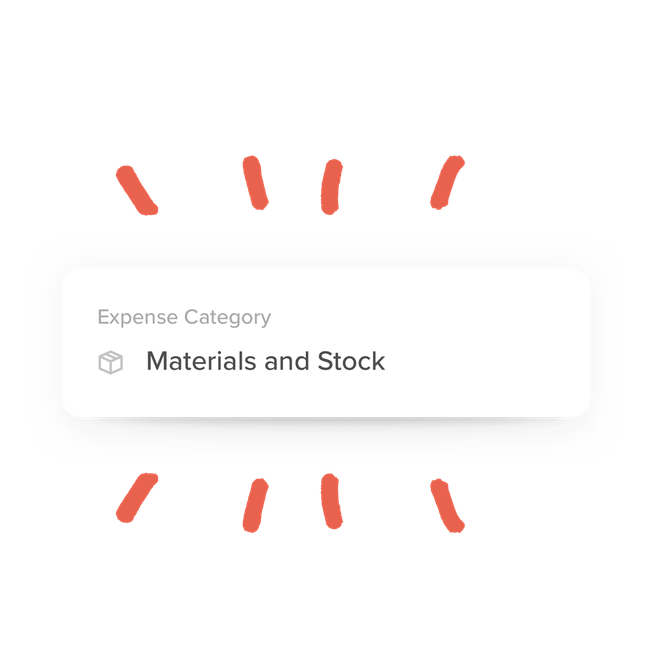

Sort it

ANNA automatically categorises your expenses, ready for your tax return

Save it

Store receipts digitally and never worry about lost receipts

Receipt capture

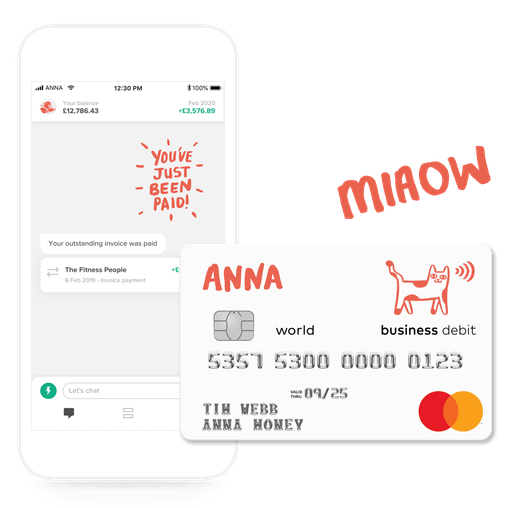

No more missing receipts

Never lose another receipt. Each time you pay with your ANNA business debit card, we’ll prompt you to photograph your receipt so you’ve got it safely stored. Phew.

Expense categorization

Ditch the data entry

So long, spreadsheets. Thanks to AI tech, ANNA scans your receipt, stores the details and assigns an expense category, without you having to type a thing.

Coming soon — send us your paper receipts

Bundles of receipts gathering dust? Post them to us and we’ll scan and store them with all the others.

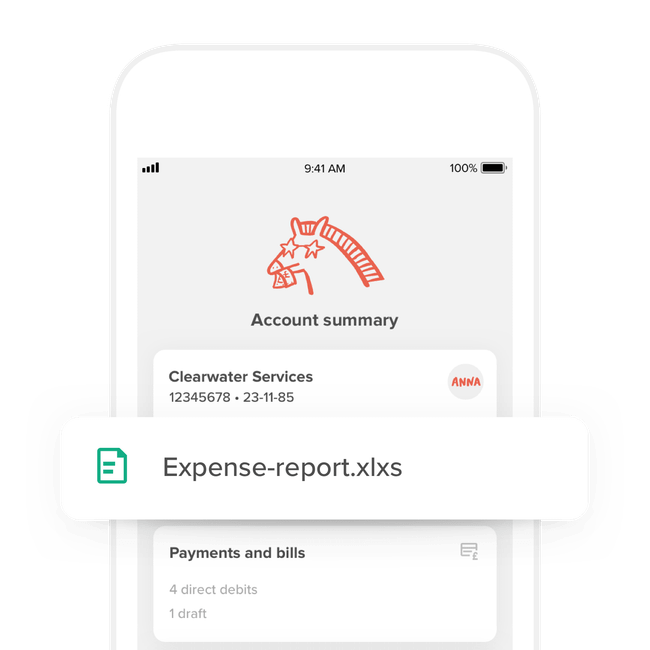

Automated bookkeeping

Simplify your financial life

Life’s busy enough without having your financial data scattered in different places. With ANNA, all your expenses, invoices and transactions are kept together, accessible by you or your accountant at any time.

Stay in control with expense reports

All your expenses are automatically categorised and summarised in reports, so you can see exactly where your money’s going.

The reviews are in

Frequently asked questions

What expenses can I claim?

- As a rough guide, allowable expenses include:

- Office costs, like stationery and phone bills

- Travel costs, like parking, train and bus fares

- Clothing that’s for work purposes, like uniforms or protective gear

- Staff costs, like salaries and subcontractor costs

- Stock and raw materials

- Financial costs, like insurance and bank charges

- Business premise costs, like heating, lighting and business rates

- Advertising and marketing, including website costs

- Training courses

Do you have to keep all receipts for tax?

It’s good practice to keep all your receipts as proof of purchase, rather than relying on bank statements. You don’t need to submit them with your tax return, but you’ll need adequate records to show to HMRC if asked.

Where should I store my business receipts?

If you’re wondering how to store receipts for business expenses, ANNA is a tad more secure than your desk drawer. Simply snap your receipt on the spot - if you make a purchase with your ANNA debit card, we’ll gently remind you - and we’ll automatically scan it, categorise it and store it for safekeeping.

How long do I need to keep receipts?

Don’t throw your receipts away once you’ve claimed. Limited companies should keep them for six years after the 31 January deadline and sole traders for five years, as HMRC could ask to see them at any time in that period.

Do I need to keep physical receipts?

Your receipts can be scanned and stored electronically - you don’t have to keep paper copies. HMRC is positively encouraging people to keep digital records these days, and it also benefits you as you don’t have to worry about losing your paper receipts.

Sign up in less than 5 minutes

ANNA is a business account with an assistant that sorts your financial admin. And it’s all free while you’re starting up.