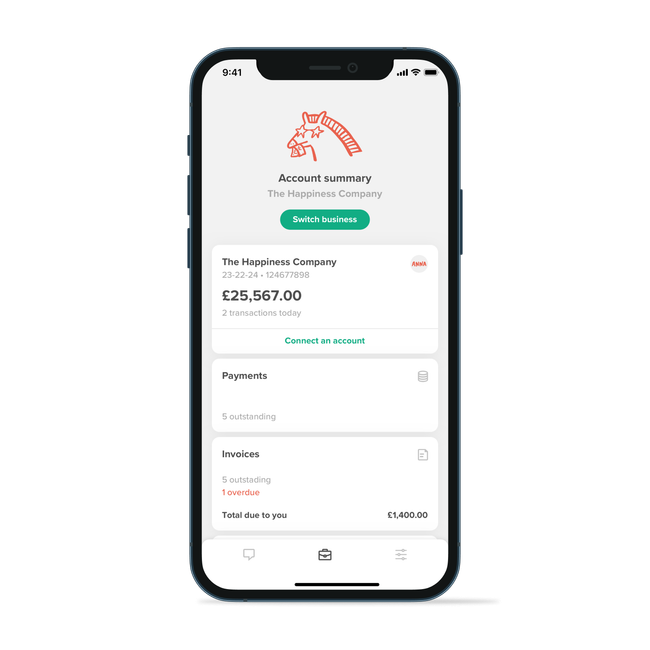

Basis period calculator

Calculate your basis period in a few simple steps.

Everything you need to know about basis period.

What is a basis period for tax?

A basis period is the time period for which a sole trader or partnership pays tax each year. For most businesses their basis period aligns with the tax year because they chose an accounting period that ends between 31 March or 5 April (which are treated the same by HMRC for Income Tax purposes).

If basis periods align with the tax year this means that in the 2021/22 tax year you would be taxed on the profits arising in the period 6 April 2021 - 5 April 2022. That sounds simple, right?

Not always, because basis periods don’t always align with the tax year so nicely. Why? The most common reasons are:

- You are a new business

- You have chosen a different accounting year end - such as 31 December, for example

Where this is the case you’ll need to work out which profits are allocated to which tax year using the basis period rules. It also normally means you pay tax twice on a portion of your profits under the basis period rules. You won’t receive relief for this double tax until you cease trading or align your accounting date with the tax years - so it’s something to consider when you’re getting started.

Once you’ve reached your third year of trading you are normally on what is known as the Current Year Basis rule. This means that you’ll be taxed on the profits for the 12 months to the accounting date that ends in that tax year.

How do you find your basis period?

The basis period rules are complex and confusing even for seasoned pros. That's why we’ve devised this handy calculator which will work it out for you and tell you the dates (or basis period) that need to be allocated to each tax year.

Traditionally you would have needed an accountant to work all this out, but now all you need to do is answer a few questions. Clever, eh?

Our calculator will work out your basis periods if you have just started trading - which is when the rules are particularly tricky. It can also show you your basis period if you’re an established business.

Please note that our calculator doesn’t currently support a change of accounting date calculation. If you’ve changed your accounting date and want to work out your basis periods then it's probably best to talk to an accountant.

Basis period vs accounting period

An accounting period is the period that you draw accounts up for and is usually a 12 month period. This is because you will normally be taxed on 12 months of profit each year. Therefore you need to know what happened in your business in that 12 months and so you pick an accounting year end or period to work out your profits for.

A basis period is the period that HMRC will actually tax you on each tax year. Usually this will be the profits that arose in that tax year. However it can differ - as we set out above.

Basis period Reform

At the moment the Government is proposing changes to the basis period rules to coincide with the launch of Making Tax Digital (MTD) for the the Income Tax Self Assessment population.

This means the basis period rules are going to be scrapped and everyone will instead be taxed on their profits arising in the tax year (there will be a transitional period to make the process smoother).

However, before you decide you won’t need our handy basis period calculator after all… the reforms have been pushed back (and may well be pushed back again). So for now you’ll need to keep following the basis period rules. The new rules are proposed for:

- Transition year 6 April 2023 - 5 April 2024

- New rules apply 6 April 2024 onwards

If you’re one of the businesses whose basis period doesn’t align with the tax year then we would recommend that you seek professional advice early as the proposed changes may negatively impact your cash flow through accelerated tax payments and administrative burden.

We’ll release a more detailed article on the reforms as the date gets closer and there is more certainty that the changes are going ahead.

A bit about us

What’s ANNA anyway?