Small business loans

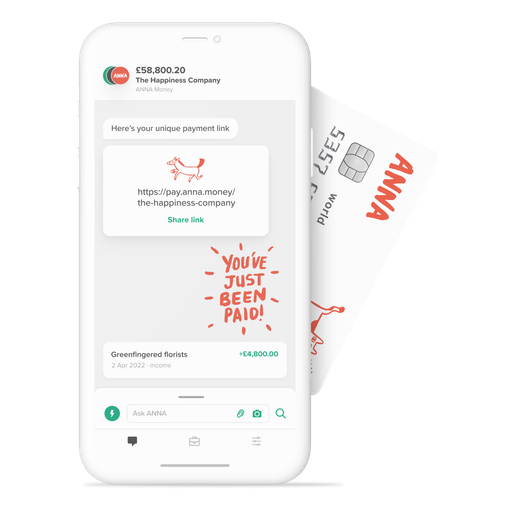

Manage your cash flow with ANNA’s credit options

Whether you want to spread the cost of a new laptop or need to expand into new markets, ANNA has handy credit solutions for your business

Let us know in chat that you’d like a loan

We’ll work with our partners to find the right product for you

We’ll let you know if your application has been successful!

Get a loan for your business with ANNA

Find what’s right for you

Coming soon

FastTrack to Credit

Grow your business faster by getting speedy access to credit

Coming soon

Pay in 3

Spread the cost of your business purchase over 3 months

Credit

Dip in when your business needs funds, and only pay interest on what you borrow

SME Lending

Get a bespoke loan, tailored for your business as you grow

Grant Finder

Identify business grants that could be right for you and your business

Grow your business faster

FastTrack to Credit

Grow your business faster with credit.

Whether you want to buy stock ahead of a sale, get specialist kit to boost productivity, or have funds available for the right opportunities, credit can be the key to growth. And with ANNA’s FastTrack to Credit, you can boost your credit score after 3 months, for only £9 a month.

Here's how it works:

Sign up to FastTrack to Credit

Make sure all your business sales go through your ANNA account

After 3 months you get access to credit of around 30% of your monthly sales income

There are no interest charges, no late payment penalties and no hidden fees.

Coming soon

Split your payments

Pay in three

Made a business purchase? Wish you could have spread the cost? We’ve partnered with SteadyPay on ANNA Pay in 3. It lets you choose purchases you’ve made, get your money back on them and then spread the repayment over 3 months.

ANNA Pay in 3 is only available to eligible ANNA customers, and you pay a Direct Debit 3% fixed fee on the money you get back into your account.

Get a loan in 1 working day

ANNA Credit

Working with SteadyPay, we’ve created ANNA Credit. Dip in when your business needs funds, and only pay interest on the money you borrow.

ANNA Credit is available for eligible, pre-selected ANNA customers. You get a pot of funds (up to £10,000), then you pay 3% monthly interest on the funds you draw down from your pot. That’s less than many high street banks charge for their overdrafts.

You can access ANNA Credit straight from the ANNA app, and the money reaches your account within 1 working day. It’s simple, quick and helps you grow your business.

Loans for small and medium sized businesses

SME Lending

As your business grows, your finances gets more complex and so do your lending needs. We work with our partners Business Score to help find you a loan that’s tailored for your business.

Because we’re able to share your business details and transaction history with Business Score, there’s much less paperwork for you to complete.

You can apply for lending in the ANNA app.

Get a grant for your business

Grant Finder

ANNA works with Swoop to identify business grants that could be right for you and your business. Swoop can help check which grants are available for you and support you with your application.

Getting started

How to apply

- Open an ANNA business account

- Ask about a loan in chat

- We’ll find the right solution for your business

The easy way to open a business account

- Enter your email to sign up for ANNA

- Download the ANNA app to your mobile

- Answer a few simple questions about your business

- Complete the application process in less than 10 minutes