Running your own business comes with lots of benefits. One of them is that you can reduce the amount of tax you owe HMRC by paying yourself in a combination of salary and dividends.

Salary and income both come with their own rates of tax, and if you can work the right combination, you can reduce how much tax you have to pay.

Please note: information in this article is applicable for an employee who falls under tax code 1257L. You can use gov.uk tax code service to check your tax code.

Paying yourself via salary

As a company director, when you pay yourself a salary you have to put yourself on the company payroll along with any employees. There are deductions made on your salary (Income Tax and National Insurance) depending on your tax band.

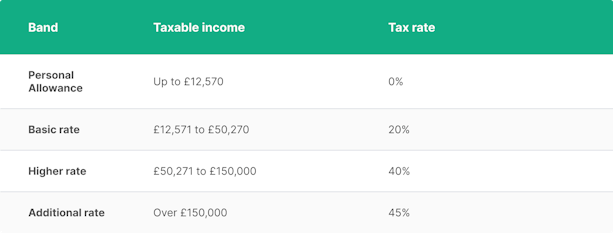

The table below shows the Income Tax rates you pay in each band. You have a Personal Allowance, which means you don’t pay Income Tax on a salary up to £12,570. Note: you don’t get an annual Personal Allowance on taxable income over £125,140.

Note: These tax bands are applicable to people in England and Wales. Scotland tax bands and rates differ.

National Insurance Contributions

If you’re paying yourself a salary, be aware there are different ‘classes’ of National Insurance, depending on your employment status and how much you earn. An employer also has to make NI contributions.

Company directors are expected to contribute to National insurance on any salary income above £11,908. If you pay yourself an annual salary of less than that, you don’t have to make NI contributions.

Being paid via dividends

Now let’s take a look at paying yourself with dividends.

Dividends are taken from a share of company profits. As a company director you can choose to be paid via dividends instead of an annual salary, but to do this the company must have profits.

No profits = no dividends (you can pay yourself a salary even if there’s no profit).

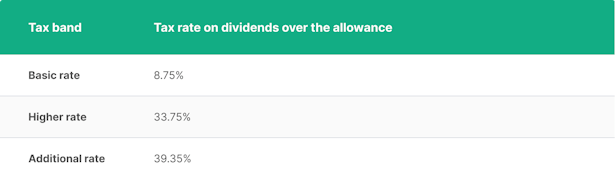

Every year you get a dividend allowance and only pay tax on any dividends income above the allowance, which is currently £2000. The good news about dividends is that you pay less tax on dividends than on a salary as it attracts a lower rate of Income Tax. Also, National Insurance contributions aren’t payable on dividends – by the employee or employer.

How much tax you pay depends on what tax band you’re in. To work out your tax band, you need to add your total dividend income to your salary income and any other secondary income. It’s also worth noting that Income Tax isn’t paid via PAYE. It’s reported on a Self Assessment tax return and paid accordingly.

Note: These tax bands are applicable to people in England and Wales. Scotland tax bands and rates differ.

How would paying myself work in practice?

HMRC provide an example on gov.uk, showing a breakdown on how income would be taxed.

Example 1

You get £3,000 in dividends and earn £29,570 in wages in the 2022 to 2023 tax year.

This gives you a total income of £32,570.

You have a Personal Allowance of £12,570. Take this off your total income to leave a taxable income of £20,000.

This is in the basic rate tax band, so you would pay:

- 20% tax on £17,000 of wages = £3400

- no tax on £2,000 of dividends, because of the dividend allowance

- 8.75% tax on £1,000 of dividends = £87.50

You fall into the primary threshold for NIC. Therefore, you will be making NIC contributions on anything you earn above £12,576 (£242 to 967 per week, 1048 to £4189 a month). This leaves your income to be considered for NIC at £19,994.

- 13.25% NIC on £19,994 of wages = £2,649.20

Therefore, you would pay £3487.50 income tax you would pay £2,649.20 NIC.

As an employer you will also need to make NIC contributions. The company will fall into the secondary threshold for NIC. Therefore, as an employer you will be making NIC contributions on anything the employee earns above £9100 (£175 per week, £758 a month).

This leaves the income to be considered for NIC at £23,470.

- 13.25% NIC on £23,470 of wages = £3109.77

Therefore, as an employer you would pay £3109.77 NIC.

This is, in total, £9,246.47 income tax and NIC for the year paid by the company director on their income and the employer.

However, look at this example, which totals less income tax paid on the same total income.

Example 2

You get £23,500 in dividends and earn £9,070 in wages in the 2022 to 2023 tax year.

This still gives you a total income of £32,570.

You have a Personal Allowance of £12,570. Take this off your total income to leave a taxable income of £20,000.

This is in the basic rate tax band, so you would pay:

- 20% tax on £0 of wages = £0.00. Your salary income is under the tax threshold.

- no tax on £2,000 of dividends, because of the dividend allowance

- 8.75% tax on £18,000 of dividends = £1575.00

- 0% NIC on salary income because you’ve earned less than £9,100.00

- 0% NIC on dividends because it does not apply

- 0% NIC to be paid by the employer because the employee’s salary does not exceed NIC secondary threshold.

Therefore, in total you would pay £1575.00 income tax and £0.00 on NIC as an employee or an employer.

As a comparison, example 1 has you pay £9426.47 tax and example 2 has you pay £1575.00 in tax for the year.

Conclusion

Looking at the above examples for paying yourself as a company director, we can see that if you pay less in salary and more in dividends, you’re liable to pay less tax on your income.

So when you’re thinking about how much to pay yourself, calculate how much tax you’d pay under PAYE and how much you’d pay on dividends through a Self Assessment tax return.

Open a business account in minutes